Starwood 2011 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

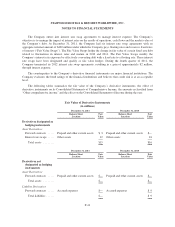

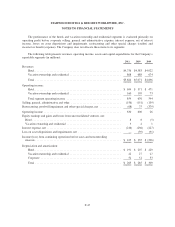

The performance of the hotels and vacation ownership and residential segments is evaluated primarily on

operating profit before corporate selling, general and administrative expense, interest expense, net of interest

income, losses on asset dispositions and impairments, restructuring and other special charges (credits) and

income tax benefit (expense). The Company does not allocate these items to its segments.

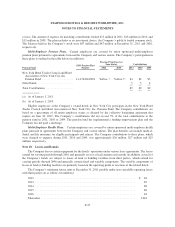

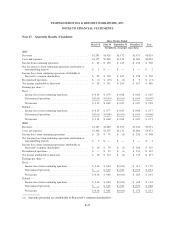

The following table presents revenues, operating income, assets and capital expenditures for the Company’s

reportable segments (in millions):

2011 2010 2009

Revenues:

Hotel ............................................................ $4,756 $4,383 $4,022

Vacation ownership and residential .................................... 868 688 674

Total ............................................................ $5,624 $5,071 $4,696

Operating income:

Hotel ............................................................ $ 694 $ 571 $ 471

Vacation ownership and residential .................................... 160 105 73

Total segment operating income ...................................... 854 676 544

Selling, general, administrative and other ................................... (156) (151) (139)

Restructuring, goodwill impairment and other special charges, net ............... (68) 75 (379)

Operating income ...................................................... 630 600 26

Equity earnings and gains and losses from unconsolidated ventures, net:

Hotel .............................................................. 8 8 (5)

Vacation ownership and residential ......................................321

Interest expense, net .................................................... (216) (236) (227)

Loss on asset dispositions and impairments, net .............................. — (39) (91)

Income (loss) from continuing operations before taxes and noncontrolling

interests ............................................................ $ 425 $ 335 $ (296)

Depreciation and amortization:

Hotel ............................................................ $ 191 $ 207 $ 229

Vacation ownership and residential .................................... 22 27 27

Corporate ........................................................ 52 51 53

Total ............................................................ $ 265 $ 285 $ 309

F-47