Starwood 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

II. COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

Our executive compensation program is designed to attract, motivate and retain executive officers and

other key employees who contribute to the Company’s success in a way that rewards performance and

aligns pay with our stockholders’ long-term interests. The Compensation Committee reviews the

Company’s overall compensation strategy for all employees, including our Named Executive Officers, on an

annual basis. In the course of this review, the Compensation Committee considers the Company’s current

compensation programs and whether to modify them or introduce new programs to better meet the

Company’s overall compensation objectives.

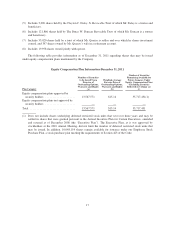

Key highlights of our executive compensation program for fiscal 2011 included:

Pay Decisions

•Base Salaries Remained Generally Unaltered — the base salary of Mr. van Paasschen was the same as

fiscal 2010; the base salaries of the other Named Executive Officers remained relatively unchanged

compared to fiscal 2010, with the exception of Mr. Turner, whose salary went up 15.6% when compared

to fiscal 2010, to more closely align with the median base salary of executives at peer companies.

•Incentive Pay Largely Contingent upon the Company’s Performance — 75% of our Named

Executive Officers’ total target annual bonus opportunity was dependent upon the Company’s

financial results, up 15% for Mr. van Paasschen and 25% for the other Named Executive Officers

compared to fiscal 2010; maximum payout eligibility for the Company financial portion of the

annual bonus was 98% for 2011, compared with 120% in 2010.

•Decrease in Equity Grants — the total equity grants made to our Named Executive Officers

decreased by approximately 2% when compared to fiscal 2010.

•CEO’s Stock Ownership Requirement Increased — Mr. van Paasschen’s stock ownership

requirement was increased to a multiple of six times his base salary, up one multiple when compared

to fiscal 2010, to keep in line with market practices.

Pay Practices

•Minimum Compensation Levels in our Executive Plan Removed to Better Align Executive

Compensation to the Company’s Financial Results — minimum compensation levels tied to the

Company’s financial results were previously removed so that bonus pool funding is based solely on

the Company’s financial performance.

•No More Tax Gross-Ups — except for tax gross-ups required to be paid under existing employment

agreements, the Compensation Committee does not intend to approve any other tax gross-ups.

•All Incentive Awards Subject to Clawback — all incentive awards received by any senior vice

president or more senior officer, including our Named Executive Officers, remain subject to a

clawback policy that mandates repayment in certain instances where there is a restatement of the

Company’s financial statements.

•No Hedging Activities Linked to Company Stock — officers and directors of the Company,

including our Named Executive Officers, were required to refrain from engaging in any hedging or

monetization transaction directly linked to Company stock.

•Stock Ownership Requirements — all of our executive officers, including our Named Executive

Officers, were required to hold a number of shares having a market value equal to or greater than a

multiple of each executive’s base salary.

•Formal Evaluation Process — the Compensation Committee conducted a formal performance review of

Mr. van Paasschen and determined whether and to what extent the Company’s financial performance

goals were achieved; Mr. van Paasschen, together with the Chief Human Resources Officer and with

oversight and input from the Compensation Committee conducted a formal performance review of the

other Named Executive Officers through the Performance Management Process.

•Compensation Consultants Retained — the Compensation Committee retained Meridian

Compensation Partners, LLC to assist it in the review and determination of compensation awards for

the Named Executive Officers.

20