Starwood 2011 Annual Report Download - page 96

Download and view the complete annual report

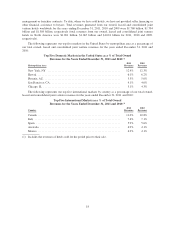

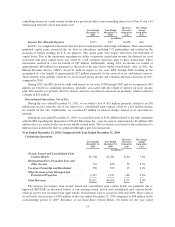

Please find page 96 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Loan Loss Reserves. For the vacation ownership and residential segment, we record an estimate of expected

uncollectibility on our VOI notes receivable as a reduction of revenue at the time we recognize a timeshare sale.

We hold large amounts of homogeneous VOI notes receivable and therefore assess uncollectibility based on

pools of receivables. In estimating loan loss reserves, we use a technique referred to as static pool analysis, which

tracks defaults for each year’s mortgage originations over the life of the respective notes and projects an

estimated default rate. As of December 31, 2011, the average estimated default rate for our pools of receivables

was 9.9%.

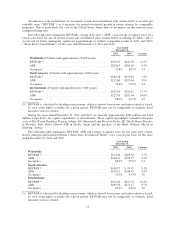

The primary credit quality indicator used by us to calculate the loan loss reserve for the vacation ownership

notes is the origination of the notes by brand (Sheraton, Westin, and Other), as we believe there is a relationship

between the default behavior of borrowers and the brand associated with the vacation ownership property they

have acquired. In addition to quantitatively calculating the loan loss reserve based on its static pool analysis, we

supplement the process by evaluating certain qualitative data, including the aging of the respective receivables,

current default trends by brand and origination year, and the Fair Isaac Corporation (“FICO”) scores of the

buyers.

Given the significance of our respective pools of VOI notes receivable, a change in the projected default rate

can have a significant impact to its loan loss reserve requirements, with a 0.1% change estimated to have an

impact of approximately $4 million.

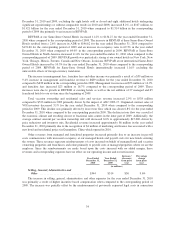

We consider a VOI note receivable delinquent when it is more than 30 days outstanding. All delinquent

loans are placed on nonaccrual status and we do not resume interest accrual until payment is made. Upon

reaching 120 days outstanding, the loan is considered to be in default and we commence the repossession

process. Uncollectible VOI notes receivable are charged off when title to the unit is returned to us. We generally

do not modify vacation ownership notes that become delinquent or upon default.

For the hotel segment, we measure the impairment of a loan based on the present value of expected future

cash flows, discounted at the loan’s original effective interest rate, or the estimated fair value of the collateral.

For impaired loans, we establish a specific impairment reserve for the difference between the recorded

investment in the loan and the present value of the expected future cash flows or the estimated fair value of the

collateral. We apply the loan impairment policy individually to all loans in the portfolio and do not aggregate

loans for the purpose of applying such policy. For loans that we have determined to be impaired, we recognize

interest income on a cash basis.

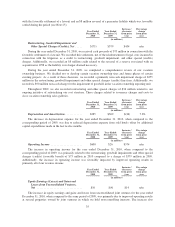

Assets Held for Sale. We consider properties to be assets held for sale when management approves and

commits to a formal plan to actively market a property or group of properties for sale and a signed sales contract

and significant non-refundable deposit or contract break-up fee exist. Upon designation as an asset held for sale,

we record the carrying value of each property or group of properties at the lower of its carrying value which

includes allocable segment goodwill or its estimated fair value, less estimated costs to sell, and we stop recording

depreciation expense. Any gain realized in connection with the sale of a property for which we have significant

continuing involvement (such as through a long-term management agreement) is deferred and recognized over

the initial term of the related agreement. The operations of the properties held for sale prior to the sale date are

recorded in discontinued operations unless we will have continuing involvement (such as through a management

or franchise agreement) after the sale.

Legal Contingencies. We are subject to various legal proceedings and claims, the outcomes of which are

subject to significant uncertainty. An estimated loss from a loss contingency should be accrued by a charge to

income if it is probable that an asset has been impaired or a liability has been incurred and the amount of the loss

can be reasonably estimated. We evaluate, among other factors, the degree of probability of an unfavorable

outcome and the ability to make a reasonable estimate of the amount of loss. Changes in these factors could

materially impact our financial position or our results of operations.

Income Taxes. We provide for income taxes in accordance with principles contained in ASC 740, Income

Taxes. Under these principles, we recognize the amount of income tax payable or refundable for the current year

and deferred tax assets and liabilities for the future tax consequences of events that have been recognized in our

financial statements or tax returns.

28