Starwood 2011 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

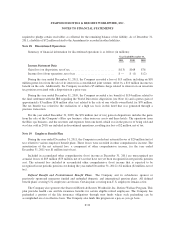

Given the significance of the Company’s respective pools of VOI notes receivable, a change in the projected

default rate can have a significant impact to its loan loss reserve requirements, with a 0.1% change estimated to

have an impact of approximately $4 million.

The Company considers a VOI note receivable delinquent when it is more than 30 days outstanding. All

delinquent loans are placed on nonaccrual status and the Company does not resume interest accrual until payment

is made. Upon reaching 120 days outstanding, the loan is considered to be in default and the Company

commences the repossession process. Uncollectible VOI notes receivable are charged off when title to the unit is

returned to the Company. The Company generally does not modify vacation ownership notes that become

delinquent or upon default.

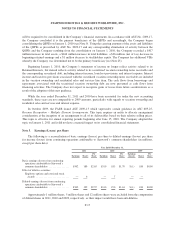

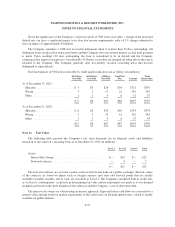

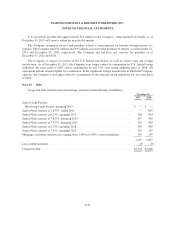

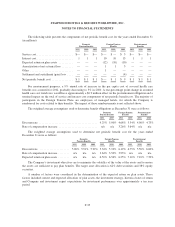

Past due balances of VOI notes receivable by credit quality indicators are as follows (in millions):

30-59 Days 60-89 Days >90 Days Total Past Total

Past Due Past Due Past Due Due Current Receivables

As of December 31, 2011:

Sheraton ....................... $ 5 $3 $26 $34 $321 $355

Westin ........................ 3 2 17 22 345 367

Other ......................... 1 1 4 6 31 37

$ 9 $6 $47 $62 $697 $759

As of December 31, 2010:

Sheraton ....................... $ 6 $4 $30 $40 $314 $354

Westin ........................ 5 3 33 41 342 383

Other ......................... 1 1 4 6 37 43

$12 $8 $67 $87 $693 $780

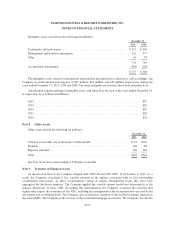

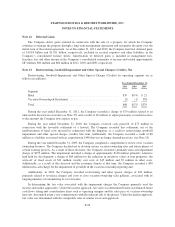

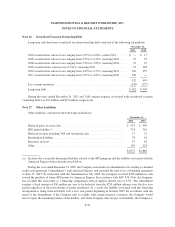

Note 11. Fair Value

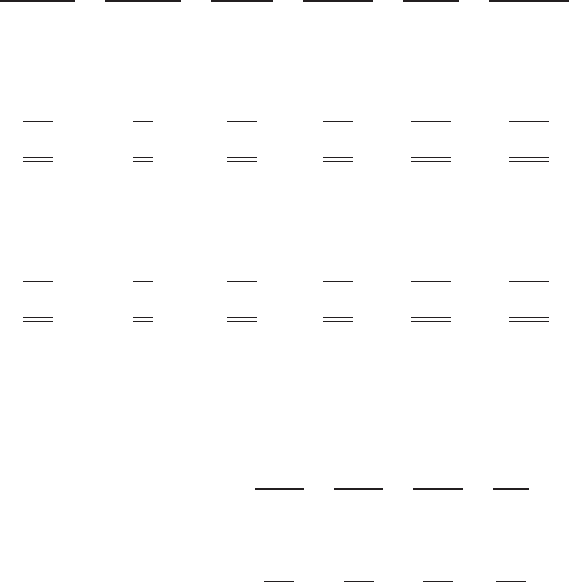

The following table presents the Company’s fair value hierarchy for its financial assets and liabilities

measured at fair value on a recurring basis as of December 31, 2011 (in millions):

Level 1 Level 2 Level 3 Total

Assets:

Interest Rate Swaps .................................. $— $12 $— $12

Forward contracts .................................... — 3 — 3

$— $15 $— $15

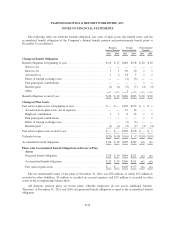

The forward contracts are over the counter contracts that do not trade on a public exchange. The fair values

of the contracts are based on inputs such as foreign currency spot rates and forward points that are readily

available on public markets, and as such, are classified as Level 2. The Company considered both its credit risk,

as well as its counterparties’ credit risk in determining fair value and no adjustment was made as it was deemed

insignificant based on the short duration of the contracts and the Company’s rate of short-term debt.

The interest rate swaps are valued using an income approach. Expected future cash flows are converted to a

present value amount based on market expectations of the yield curve on floating interest rates, which is readily

available on public markets.

F-25