Starwood 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In light of Mr. Siegel’s accomplishments, he received an “accomplished objectives” PMP performance rating and

was awarded a payout at 98% of target for the strategic/operational portion of the annual bonus, for a total annual

bonus of $625,720 for 2011, representing 98% of his overall annual bonus target.

Mr. Turner’s accomplishments for the 2011 performance year included the following:

• managed the Global Development team to execute agreements for 70 new managed hotels (approximately

20,000 rooms) and 42 new franchised hotels (approximately 9,000 rooms), a significant portion of which

opened in 2011 and a portion of which will open in the future;

• achieved 4.2% global net rooms growth driven in large part by the opening of 81 new hotels representing

approximately 21,000 rooms;

• streamlined processes to maximize conversion opportunities as evidenced by 32 conversion deals signed

in 2011 (versus 23 in 2010), 17 of which resulted in opened hotels in 2011 (versus 8 in 2010); and

• completed strategic asset sale transactions generating net proceeds of $290 million.

In light of Mr. Turner’s accomplishments in 2011, he received an “accomplished objectives” PMP performance

rating and was awarded a payout at 98% of target for the strategic/operational portion of the annual bonus, for a

total annual bonus of $735,020 for 2011, representing 98% of his overall annual bonus target.

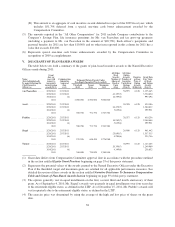

Overall, the Compensation Committee paid the Named Executive Officers individual bonuses under the

Executive Plan at 98% of target, which reflected the target payout based upon the Company’s financial

performance goals, and the contribution made by each of the Named Executive Officers under his strategic/

operational goals.

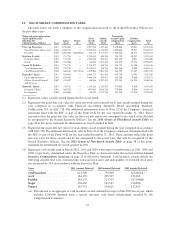

Annual awards made to our Named Executive Officers under the Executive Plan with respect to 2011

performance are reflected in the 2011 Summary Compensation Table on page 37 of this proxy statement and

described in the accompanying narrative.

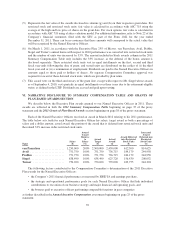

Long-Term Incentive Compensation. Like the annual incentives described above, long-term incentives

are a key part of the Company’s executive compensation program. Long-term incentives are strongly tied to

returns experienced by stockholders, providing a direct link between the interests of stockholders and the Named

Executive Officers. Long-term incentive compensation for our Named Executive Officers consists primarily of

equity compensation awards granted annually (in February of each year following the announcement of the

Company’s earnings for the previous year) under the Company’s LTIP and secondarily of the portion of the

Executive Plan awards that are deferred in the form of deferred stock awards. Taken together, approximately

60% of total compensation at target award levels is equity-based long-term incentive compensation.

The Compensation Committee grants awards under the LTIP to Mr. van Paasschen consisting of a

combination of stock options and restricted stock. Mr. van Paasschen’s employment agreement, which reflects an

emphasis on performance and long-term incentives, provides that in the event of strong financial and individual

performance, Mr. van Paasschen benefits greatly in the form of long-term incentive compensation that, for the

2011 fiscal year, would not be less than $5,000,000. The Compensation Committee generally grants awards

under the LTIP to all other Named Executive Officers consisting of a combination of stock options and restricted

stock awards. For the other Named Executive Officers, compensation is also geared towards performance and

long-term incentives, but to a lesser degree than Mr. van Paasschen. The Compensation Committee believes an

emphasis on long-term equity compensation (through the use of stock options and restricted stock) is particularly

appropriate for the leader of a management team committed to the creation of stockholder value.

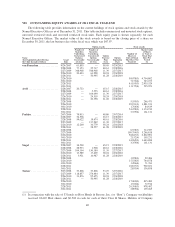

In 2011, for all Named Executive Officers, the Compensation Committee used a grant approach in which

the award was articulated as a dollar value. Under this approach, an overall award value, in dollars, was

determined for each Named Executive Officer based upon our compensation strategy and competitive market

positioning taking into account the Company and individual performance factors for the Named Executive

Officers described in the Annual Incentive Compensation section beginning on page 25 of the proxy statement.

30