Starwood 2011 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

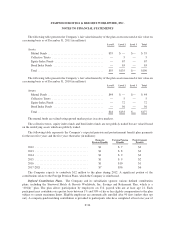

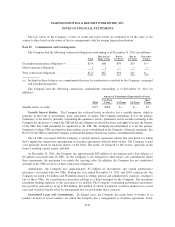

service. The amount of expense for matching contributions totaled $15 million in 2011, $13 million in 2010, and

$15 million in 2009. The plan includes as an investment choice, the Company’s publicly traded common stock.

The balances held in the Company’s stock were $67 million and $87 million at December 31, 2011 and 2010,

respectively.

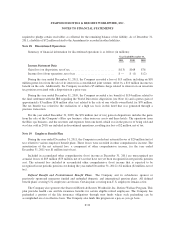

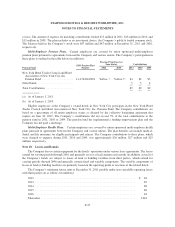

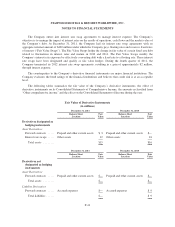

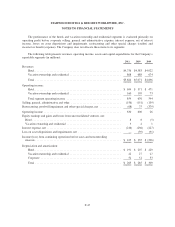

Multi-Employer Pension Plans. Certain employees are covered by union sponsored multi-employer

pension plans pursuant to agreements between the Company and various unions. The Company’s participation in

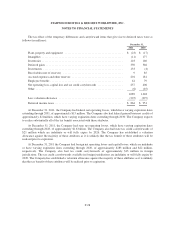

these plans is outlined in the table below (in millions):

Pension Fund

EIN/ Pension Plan

Number

Pension Protection Act

Zone Status Contributions

2011 2010 2011 2010 2009

New York Hotel Trades Council and Hotel

Association of New York City, Inc.

Pension Fund ...................... 13-1764242/001 Yellow (a) Yellow (b) $4 $4 $5

Other Funds ......................... 5 5 4

Total Contributions ................... $9 $9 $9

(a) As of January 1, 2011

(b) As of January 1, 2010

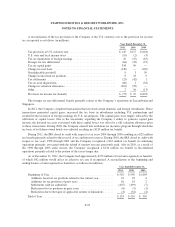

Eligible employees at the Company’s owned hotels in New York City participate in the New York Hotel

Trades Council and Hotel Association of New York City, Inc. Pension Fund. The Company contributions are

based on a percentage of all union employee wages as dictated by the collective bargaining agreement that

expires on June 30, 2012. The Company’s contributions did not exceed 5% of the total contributions to the

pension fund in 2011, 2010 or 2009. The pension fund has implemented a funding improvement plan and the

Company has not paid a surcharge.

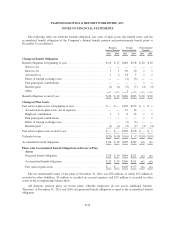

Multi-Employer Health Plans. Certain employees are covered by union sponsored multi-employer health

plans pursuant to agreements between the Company and various unions. The plan benefits can include medical,

dental and life insurance for eligible participants and retirees. The Company contributions to these plans, which

were charged to expense during 2011, 2010 and 2009, was approximately $26 million, $27 million and $29

million, respectively.

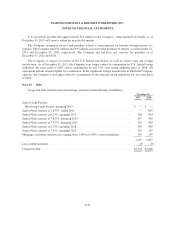

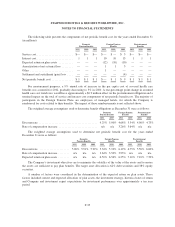

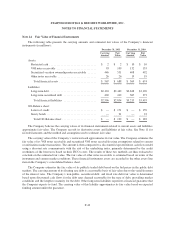

Note 20. Leases and Rentals

The Company leases certain equipment for the hotels’ operations under various lease agreements. The leases

extend for varying periods through 2016 and generally are for a fixed amount each month. In addition, several of

the Company’s hotels are subject to leases of land or building facilities from third parties, which extend for

varying periods through 2096 and generally contain fixed and variable components. The variable components of

leases of land or building facilities are primarily based on the operating profit or revenues of the related hotels.

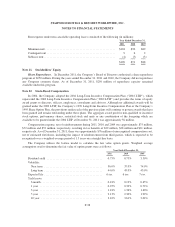

The Company’s minimum future rents at December 31, 2011 payable under non-cancelable operating leases

with third parties are as follows (in millions):

2012 ...................................................................... $ 84

2013 ...................................................................... 89

2014 ...................................................................... 88

2015 ...................................................................... 86

2016 ...................................................................... 84

Thereafter .................................................................. 1,024

F-37