Starwood 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

controlling interest in a joint venture in which we previously held a non-controlling interest (see Note 4) and a $4

million gain from the sale of non-hotel assets.

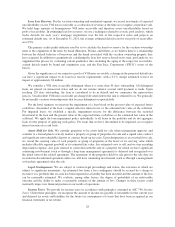

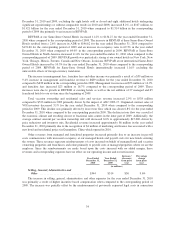

Year Ended

December 31,

2011

Year Ended

December 31,

2010

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Income Tax (Benefit) Expense ............ $(75) $27 $(102) n/m

In 2011, we completed transactions that involved certain domestic and foreign subsidiaries. These transactions

generated capital gains, increased the tax basis in subsidiaries including U.S partnerships and resulted in the

inclusion of foreign earnings for U.S. tax purposes. The capital gains were largely reduced by the utilization of

capital losses. Due to the uncertainty regarding our ability to generate capital gain income, the deferred tax asset

associated with these capital losses was offset by a full valuation allowance prior to these transactions. These

transactions resulted in a net tax benefit of $87 million. Additionally, during 2011, an income tax benefit of

approximately $60 million was generated as the result of the sale of two wholly-owned hotels. Also, in 2011, the

Internal Revenue Service (“IRS”) closed its audit in respect to tax years 2004 through 2006 resulting in the

recognition of a tax benefit of approximately $25 million, primarily for the reversal of tax and interest reserves.

These benefits were partially offset by tax on increased pretax income and valuation allowance increases in 2011

compared to 2010.

During 2010, the IRS closed its audit with respect to tax years 1998 through 2003 and we recognized a $42

million tax benefit in continuing operations, primarily associated with the refund of interest on taxes already

paid. This benefit was partially offset by interest and taxes recorded on uncertain tax positions, which resulted in

a charge of $23 million.

Discontinued Operations, Net of Tax

During the year ended December 31, 2011, we recorded a loss of $13 million primarily related to an $18

million pre-tax loss from the sale of our interest in a consolidated joint venture, offset by a $10 million income

tax benefit on the sale. Additionally, we recorded $5 million of interest charges related to an uncertain tax

position.

During the year ended December 31, 2010, we recorded a gain of $134 million related to the final settlement

with the IRS regarding the disposition of World Directories Inc. a pre-tax gain of approximately $3 million ($36

million after tax) related to the sale of one wholly-owned hotel. The tax benefit was related to the realization of a

high tax basis in this hotel that was generated through a previous transaction.

Year Ended December 31, 2010 Compared with Year Ended December 31, 2009

Continuing Operations

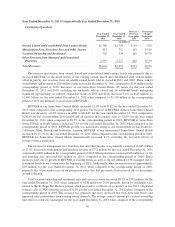

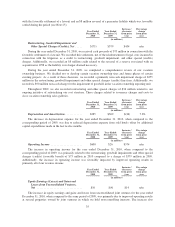

Year Ended

December 31,

2010

Year Ended

December 31,

2009

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

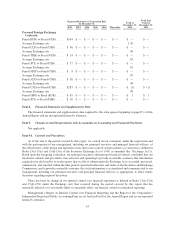

Owned, Leased and Consolidated Joint

Venture Hotels ....................... $1,704 $1,584 $120 7.6%

Management Fees, Franchise Fees and

Other Income ........................ 712 658 54 8.2%

Vacation Ownership and Residential ....... 538 523 15 2.9%

Other Revenues from Managed and

Franchised Properties ................. 2,117 1,931 186 9.6%

Total Revenues ........................ $5,071 $4,696 $375 8.0%

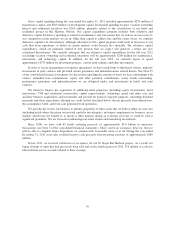

The increase in revenues from owned, leased and consolidated joint venture hotels was primarily due to

improved REVPAR (as discussed below) at our existing owned, leased and consolidated joint venture hotels,

offset in part by lost revenues from eight wholly owned hotels sold or closed in 2010 and 2009. These sold or

closed hotels had revenues of $18 million in the year ended December 31, 2010 compared to $98 million in the

corresponding period of 2009. Revenues at our Same-Store Owned Hotels (54 hotels for the year ended

33