Starwood 2011 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

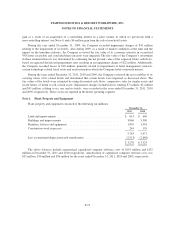

apparent that the media campaign will not take place, all costs are expensed at that time. During the years ended

December 31, 2011, 2010 and 2009, the Company incurred approximately $149 million, $132 million and $118

million of advertising expense, respectively, a significant portion of which was reimbursed by managed and

franchised hotels.

Use of Estimates. The preparation of financial statements in conformity with accounting principles

generally accepted in the United States requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the

financial statements and the reported amounts of revenues and expenses during the reporting period. Actual

results could differ from those estimates.

Reclassifications. Certain reclassifications have been made to the prior years’ financial statements to

conform to the current year presentation.

Impact of Recently Issued Accounting Standards.

Adopted Accounting Standards

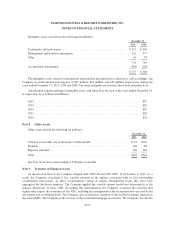

In September 2011, the Financial Accounting Standards Board (“FASB”) issued ASU No. 2011-08,

“Intangibles-Goodwill and Other (Topic 350): Testing Goodwill for Impairment”. This topic permits an entity to

assess qualitative factors to determine whether it is more likely than not that the fair value of the reporting unit is

less than its carrying amount as a basis to determine whether an additional impairment test is necessary. This

topic is for annual and interim goodwill impairment tests performed for fiscal years beginning after

December 15, 2011 with early adoption allowed. The Company early adopted this topic during the fourth quarter

of 2011 in conjunction with its annual impairment testing (see Note 7).

In September 2011, the FASB issued ASU No. 2011-09, “Compensation-Retirement Benefits-

Multiemployer Plans (Subtopic 715-80): Disclosures about an Employer’s Participation in a Multiemployer

Plan”. This subtopic addresses concerns from users of financial statements on the lack of transparency about an

employer’s participation in a multiemployer pension plan. The disclosures also will indicate the financial health

of all of the significant plans in which the employer participates and assist a financial statement user to access

additional information that is available outside of the financial statements. The subtopic is effective for annual

reporting periods ending after December 15, 2011. The Company adopted this topic as of December 31, 2011

(see Note 19).

In July 2010, the FASB issued ASU No. 2010-20, “Receivables (Topic 310): Disclosures about the Credit

Quality of Financing Receivables and the Allowance for Credit Losses.” This topic requires disclosures of

financing receivables and allowance for credit losses on a disaggregated basis. The balance sheet related

disclosures are required beginning at December 31, 2010 and the statements of income disclosures are required,

beginning for the three months ended March 31, 2011. The Company adopted this topic on December 31, 2010

(see Note 10).

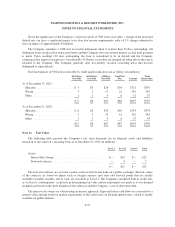

In June 2009, the FASB issued ASU No. 2009-16, “Transfers and Servicing (Topic 860): Accounting for

Transfers of Financial Assets” (formerly Statement of Financial Accounting Standards (“SFAS”) No. 166), and

ASU No. 2009-17, “Consolidations (Topic 810): Improvements to Financial Reporting by Enterprises Involved

with Variable Interest Entities” (formerly SFAS No. 167).

ASU No. 2009-16 amended the accounting for transfers of financial assets. Under ASU No. 2009-16, the

qualifying special purpose entities (“QSPEs”) used in the Company’s securitization transactions are no longer

exempt from consolidation. ASU No. 2009-17 prescribes an ongoing assessment of the Company’s involvement

in the activities of the QSPEs and the Company’s rights or obligations to receive benefits or absorb losses of the

trusts that could be potentially significant in order to determine whether those variable interest entities (“VIEs”)

F-16