Starwood 2011 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(3) Based on information contained in a Schedule 13G/A, dated February 6, 2012 (the “Vanguard 13G/A”) filed

by The Vanguard Group, Inc. (“Vanguard”) with the SEC, with respect to the Company, reporting beneficial

ownership as of December 31, 2011. The Vanguard 13G/A reports that Vanguard has sole voting power

over 271,130 shares, sole dispositive power over 10,108,261 shares and shared dispositive power over

271,130 shares. Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of Vanguard, holds

271,130 shares and directs the voting of those shares.

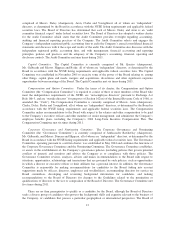

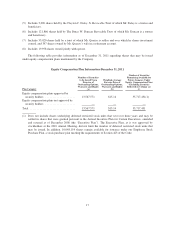

BENEFICIAL OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The table below shows the beneficial ownership of Company shares of (i) each director, (ii) each nominee

for director, (iii) our Chief Executive Officer, our Chief Financial Officer and each of the other three most highly

paid executive officers and (iv) all directors and executive officers as a group, as of January 31, 2012. Beneficial

ownership includes any shares that a director, nominee for director or executive officer may acquire pursuant to

stock options and other derivative securities that are exercisable on that date or that will become exercisable

within 60 days thereafter. Unless otherwise indicated, the stockholder had sole voting and dispositive power over

the shares.

Name (Listed alphabetically)

Amount and Nature of

Beneficial Ownership Percent of Class

Adam M. Aron ................................................ 55,378(1)(2) (3)

Matthew E. Avril .............................................. 127,451(1) (3)

Charlene Barshefsky ........................................... 45,769(1)(4) (3)

Thomas E. Clarke .............................................. 31,254(1) (3)

Clayton C. Daley, Jr. ........................................... 28,286(1)(4)(5) (3)

Bruce W. Duncan .............................................. 225,979(1)(4)(6) (3)

Lizanne Galbreath ............................................. 54,245(1)(4) (3)

Eric Hippeau .................................................. 68,069(1)(4) (3)

Vasant M. Prabhu .............................................. 433,130(1) (3)

Stephen R. Quazzo ............................................. 79,509(1)(7) (3)

Thomas O. Ryder .............................................. 84,814(1)(4) (3)

Kenneth S. Siegel .............................................. 287,451(1) (3)

Simon M. Turner .............................................. 393,345(1)(8) (3)

Frits van Paasschen ............................................ 845,863(1) (3)

Kneeland C. Youngblood ........................................ 40,128(1) (3)

All Directors, Nominees for Directors and executive officers as a group

(17 persons) ................................................ 3,040,619(1) (3)

(1) Includes shares subject to presently exercisable options, and options, restricted stock and restricted stock

units that will become exercisable or vest within 60 days of January 31, 2012, as follows: 32,970 for

Mr. Aron; 127,451 for Mr. Avril; 29,614 for Ambassador Barshefsky; 112,047 for Mr. Jeffrey M. Cava;

24,860 for Dr. Clarke; 20,573 for Mr. Daley; 76,014 for Mr. Duncan; 40,593 for Ms. Galbreath; 40,593 for

Mr. Hippeau; 117,151 for Mr. Philip P. McAveety; 409,780 for Mr. Prabhu; 40,593 for Mr. Quazzo; 40,593

for Mr. Ryder; 223,662 for Mr. Siegel; 366,405 for Mr. Turner; 843,832 for Mr. van Paasschen and 29,614

for Dr. Youngblood.

(2) Includes 10,000 shares owned jointly with spouse.

(3) Less than 1%.

(4) Amount includes the following number of “phantom” stock units received as a result of the following

directors’ election to defer directors’ annual fees: 4,056 for Ambassador Barshefsky; 4,198 for Mr. Daley;

7,300 for Mr. Duncan; 12,623 for Ms. Galbreath; 25,625 for Mr. Hippeau; and 20,579 for Mr. Ryder.

16