Starwood 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

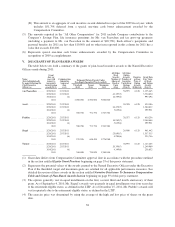

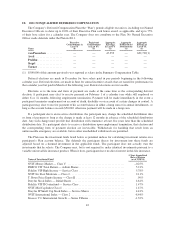

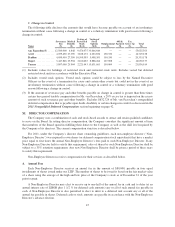

(5) Represents the fair value of the awards disclosed in columns (g) and (h) on their respective grant dates. For

restricted stock and restricted stock units, fair value is calculated in accordance with ASC 718 using the

average of the high and low price of shares on the grant date. For stock options, fair value is calculated in

accordance with ASC 718 using a lattice valuation model. For additional information, refer to Note 22 of the

Company’s financial statements filed with the SEC as part of the Form 10-K for the year ended

December 31, 2011. There can be no assurance that these amounts will correspond to the actual value that

will be recognized by the Named Executive Officers.

(6) On March 1, 2011, in accordance with the Executive Plan, 25% of Messrs. van Paasschen, Avril, Prabhu,

Siegel and Turner’s annual bonus with respect to 2010 performance was converted into restricted stock units

and the number of units was increased by 33%. The amount included in Stock awards column in the 2011

Summary Compensation Table only includes the 33% increase, as the deferral of the bonus amount is

disclosed separately. These restricted stock units vest in equal installments on the first, second and third

fiscal year-ends following the date of grant, and vested units are distributed on the earlier of (i) the third

fiscal year-end or (ii) a termination of employment. Dividends are paid to the Named Executive Officers in

amounts equal to those paid to holders of shares. No separate Compensation Committee approval was

required for award of these deferred stock units, which are provided by plan terms.

(7) This award vests on the third anniversary of the grant date, except with respect to Mr. Siegel whose awards

as of September 4, 2010, vest quarterly in equal installments over three years due to his retirement-eligible

status, as defined in the LTIP. Dividends are accrued and paid upon vesting.

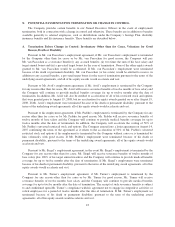

VI. NARRATIVE DISCLOSURE TO SUMMARY COMPENSATION TABLE AND GRANTS OF

PLAN-BASED AWARDS SECTION

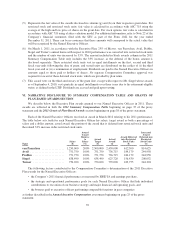

We describe below the Executive Plan awards granted to our Named Executive Officers in 2011. These

awards are reflected in both the 2011 Summary Compensation Table beginning on page 37 of the proxy

statement and the 2011 Grants of Plan-Based Awards section beginning on page 38 of the proxy statement.

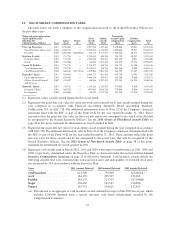

Each of the Named Executive Officers received an award in March 2012 relating to his 2011 performance.

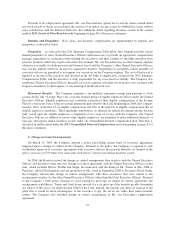

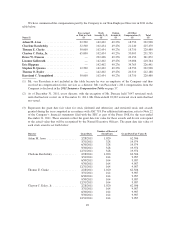

The table below sets forth for each Named Executive Officer his salary, target award as both a percentage of

salary and a dollar amount, actual award, the portion of the award that is deferred into restricted stock units and

the related 33% increase in his restricted stock units.

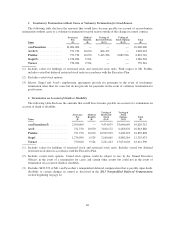

Name

Salary

($)

Award

Target

Relative

to

Salary

(%)

Award

Target

($)

Actual

Award

($)

Award Deferred

into Restricted

Stock Units

($)

Increased

Award

Deferred into

Restricted

Stock Units

($)

van Paasschen ................ 1,250,000 200% 2,500,000 2,450,000 612,500 814,625

Avril ........................ 751,750 100% 751,750 736,715 184,179 244,958

Prabhu ...................... 751,750 100% 751,750 736,715 184,179 244,958

Siegel ........................ 638,490 100% 638,490 625,720 156,430 208,052

Turner ...................... 750,020 100% 750,020 735,020 183,755 244,394

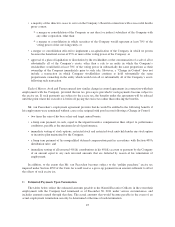

The following factors contributed to the Compensation Committee’s determination of the 2011 Executive

Plan awards for the Named Executive Officers:

• the Company’s 2011 financial performance as measured by EBIDTA and earnings per share,

• the strategic and operational performance goals for each Named Executive Officer that link individual

contributions to execution of our business strategy and major financial and operating goals, and

• the bonuses paid to executive officers performing comparable functions in peer companies

as further described in the Annual Incentive Compensation assessment beginning on page 25 of the proxy

statement.

39