Starwood 2011 Annual Report Download - page 97

Download and view the complete annual report

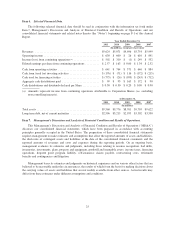

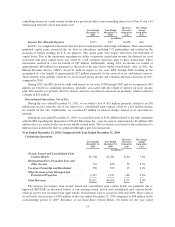

Please find page 97 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Deferred tax assets and liabilities are measured using enacted tax rates in effect for the year in which those

temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a

change in tax rates is recognized in earnings in the period when the new rate is enacted. Deferred tax assets are

evaluated for future realization and reduced by a valuation allowance to the extent we believe a portion will not

be realized. We consider many factors when assessing the likelihood of future realization of our deferred tax

assets, including our recent cumulative earnings experience and expectations of future taxable income by taxing

jurisdiction, the carry-forward periods available to us for tax reporting purposes and tax attributes.

We measure and recognize the amount of tax benefit that should be recorded for financial statement

purposes for uncertain tax positions taken or expected to be taken in a tax return. With respect to uncertain tax

positions, we evaluate the recognized tax benefits for derecognition, classification, interest and penalties, interim

period accounting and disclosure requirements. Judgment is required in assessing the future tax consequences of

events that have been recognized in our financial statements or tax returns.

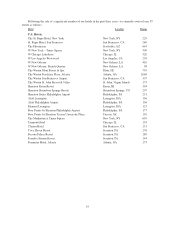

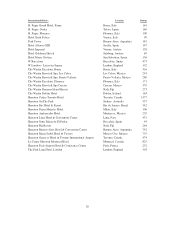

RESULTS OF OPERATIONS

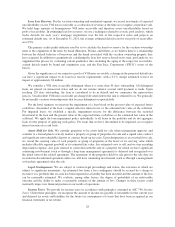

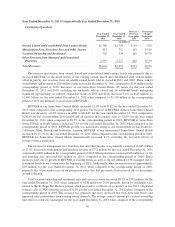

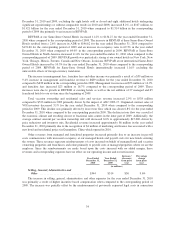

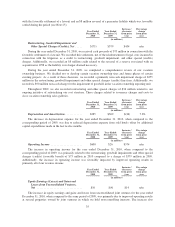

The following discussion presents an analysis of results of our operations for the years ended December 31,

2011, 2010 and 2009.

The difficult business conditions that plagued the global lodging industry in 2008 and 2009 began to

stabilize in 2010. The lodging recovery continued into 2011 as occupancies approached prior peak levels,

average daily rate increased, and new hotel supply in the developed world fell well below historic rates of

growth. While we remain cautiously optimistic, we acknowledge that known and unknown challenges could slow

down or derail the lodging recovery.

As we move forward, we believe we are uniquely positioned, due to the strength of our brands, our high-end

focus, and our geographic diversification. Starwood is particularly well positioned to take advantage of global

growth through our operating teams that have worked in the emerging markets for decades. We also expect to

grow in the developed world as we build out our underpenetrated brands in these markets. We believe that we

have the highest quality pipeline in the industry as measured by percentage growth potential as well as our focus

on valuable management contracts in the four and five star segments.

We and our hotel owners have continued to invest capital in our hotels and provide innovative ways to

utilize public space, such as our Link@Sheraton, which fosters relationships face-to-face or webcam-to-webcam,

and also by maximizing guest room conveniences. Finally, we believe our SPG loyalty guest program is an

industry leader. With our recently announced changes to the program, we expect to drive further loyalty from our

SPG members as well as attract the next wave of global elite members. As the program is constantly refined and

new promotions are offered, it provides rewards to our patrons while its growth in membership favorably impacts

our results. As we move forward to 2012, we will continue to focus on providing superior guest experiences for

our business, leisure, and group customers while maintaining a commitment to controlling our costs.

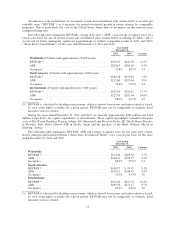

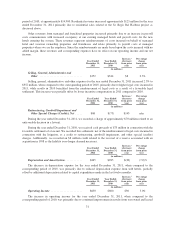

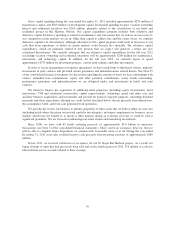

As discussed in Note 2 of our consolidated financial statements, following the adoption of ASU Nos.

2009-16 and 2009-17 on January 1, 2010, our statements of income beginning with the year ended December 31,

2010 no longer reflect securitization income, but instead report interest income, net charge-offs and certain other

income associated with all securitized loan receivables, and interest expense associated with debt issued from the

trusts to third-party investors in the same line items in our statements of income. Additionally, we no longer

record initial gains or losses on new securitization activity since securitized vacation ownership notes receivable

no longer receive sale accounting treatment. Finally, we no longer recognize gains or losses on the revaluation of

the interest-only strip receivable as that asset is not recognized in a transaction accounted for as a secured

borrowing.

Our statement of income for the year ended December 31, 2009 has not been retrospectively adjusted to

reflect the adoption of ASU Nos. 2009-16 and 2009-17. While the years ended December 31, 2010 and 2011

have been accounted for under the new accounting standards, these years are not comparable to 2009 amounts,

particularly with regards to vacation ownership and residential sales and services and interest expense.

29