Starwood 2011 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

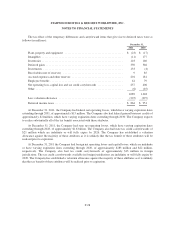

NOTES TO FINANCIAL STATEMENTS

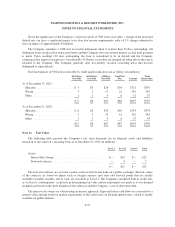

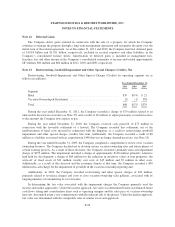

Note 4. Significant Acquisitions

During the year ended December 31, 2011, the Company executed a transaction with its former partner in a

joint venture that owned three luxury hotels in Austria. In connection with the transaction, the Company acquired

substantially the entire interest in two of the hotels in exchange for its interest in the third hotel and a cash

payment, by the Company, of approximately $27 million. The Company previously held a 47.4% ownership

interest in the hotels. In accordance with ASC 805, Business Combinations, the Company accounted for this

transaction as a step acquisition, remeasured its previously held investment to fair value and recorded the

approximately $50 million difference between fair value and its carrying value to the gain (loss) on asset

dispositions and impairments, net, line item. The fair values of the assets and liabilities acquired have been

recorded in the Company’s consolidated balance sheet, including the resulting goodwill of approximately $26

million. The Company entered into a long-term management contract for the hotel in which it exchanged its

minority ownership interest and recorded a deferred gain of approximately $30 million in connection with this

exchange.

During the year ended December 31, 2010, the Company paid approximately $23 million to acquire a

controlling interest in a joint venture in which it had previously held a non-controlling interest. The primary

business of the joint venture is to develop, license and manage restaurant concepts. The acquisition took place

after one of the Company’s former partners exercised its right to put its interest to the Company in accordance

with the terms of the joint venture agreement. In accordance with ASC 805, Business Combinations, the

Company accounted for this transaction as a step acquisition, remeasured its previously held investment to fair

value and recorded the approximately $5 million difference between fair value and its carrying value to the gain

(loss) on asset dispositions and impairments, net, line item. The fair values of the assets and liabilities acquired

were recorded in Starwood’s consolidated balance sheet, including the resulting goodwill of approximately $26

million. The results of operations going forward from the acquisition date have been included in the Company’s

consolidated statements of income.

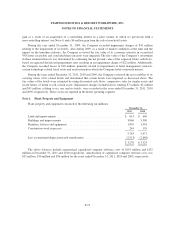

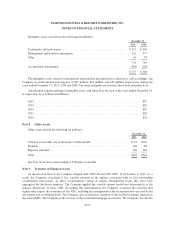

Note 5. Asset Dispositions and Impairments

During the year ended December 31, 2011, the Company sold two wholly-owned hotels for cash proceeds of

approximately $237 million. These hotels were sold subject to long-term management agreements, and the

Company recorded deferred gains of approximately $66 million relating to the sales. Also during the year ended

December 31, 2011 the Company sold its interest in a consolidated joint venture for cash proceeds of

approximately $44 million, with the buyer assuming $57 million of the Company’s debt (see Note 15). The

Company recognized a pretax loss of $18 million in discontinued operations as a result of the sale (see Note 18).

Additionally, during the year ended December 31, 2011, the Company recorded an impairment charge of

$31 million to write-off its noncontrolling interest in a joint venture that owns a hotel in Tokyo, Japan, a $16

million loss due to the impairment of fixed assets that were written down in connection with significant

renovations and related asset retirements at two properties and losses relating to the impairment of six hotels

whose carrying value exceeded their fair value. These amounts were partially offset by a $50 million gain as a

result of remeasuring the fair value of its previously held noncontrolling interest in two hotels in which it

obtained a controlling interest (see Note 4).

During the year ended December 31, 2010, the Company recorded a net loss on dispositions of

approximately $39 million, primarily related to a $53 million loss on the sale of one wholly-owned hotel subject

to a long-term management contract, a $4 million impairment of fixed assets that are being retired in connection

with a significant renovation of a wholly-owned hotel, and a $2 million impairment on one hotel whose carrying

value exceeded its fair value. These charges were partially offset by a gain of $14 million from insurance

proceeds received for a claim at a wholly-owned hotel that suffered damage from a storm in 2008, a $5 million

F-18