Starwood 2011 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

The Company had remaining restructuring accruals of $89 million as of December 31, 2011, primarily

recorded in accrued expenses.

Note 14. Income Taxes

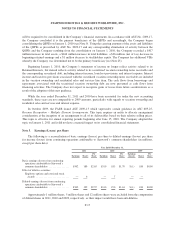

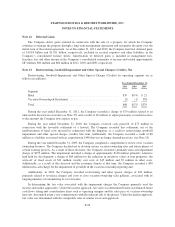

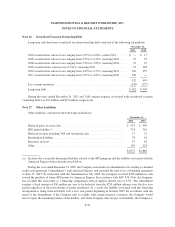

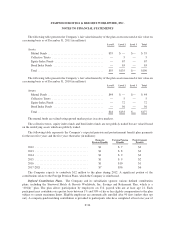

Income tax data from continuing operations of the Company is as follows (in millions):

Year Ended December 31,

2011 2010 2009

Pretax income

U.S. ......................................................... $165 $ 85 $ (76)

Foreign ...................................................... 260 250 (220)

$ 425 $335 $(296)

Provision (benefit) for income tax

Current:

U.S. federal ................................................. $(215) $ (61) $ (84)

State and local ............................................... (21) 18 12

Foreign .................................................... 88 43 38

(148) — (34)

Deferred:

U.S. federal ................................................. 62 22 (117)

State and local ............................................... (11) (7) (18)

Foreign .................................................... 22 12 (124)

73 27 (259)

$ (75) $ 27 $(293)

No provision has been made for U.S. taxes payable on undistributed foreign earnings amounting to

approximately $2.3 billion as of December 31, 2011 since these amounts are permanently reinvested. If such

earnings were repatriated, additional tax expense may result, although the calculation of such additional taxes is

not practicable.

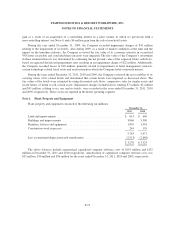

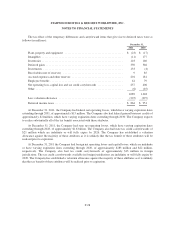

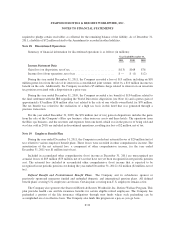

Deferred income taxes represent the tax effect of the differences between the book and tax bases of assets

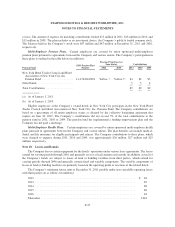

and liabilities plus carryforward items. The composition of net deferred tax balances were as follows (in

millions):

December 31,

2011 2010

Current deferred tax assets ............................................... $278 $315

Long-term deferred tax assets ............................................. 639 664

Current deferred tax liabilities (1) .......................................... (7) (4)

Long-term deferred tax liabilities .......................................... (46) (24)

Deferred income taxes ................................................... $864 $951

(1) Included in the Accrued taxes and other line item in the consolidated balance sheets.

F-27