Shaw 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

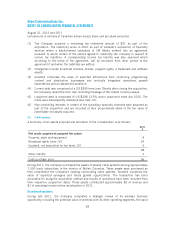

Senior notes

The senior notes are unsecured obligations and rank equally and ratably with all existing and

future senior indebtedness. The notes are redeemable at the Company’s option at any time, in

whole or in part, prior to maturity at 100% of the principal amount plus a make-whole premium.

Other

Burrard Landing Lot 2 Holdings Partnership

The Company has a 33.33% interest in the Partnership which built the Shaw Tower project

with office/retail space and living/working space in Vancouver, BC. In the fall of 2004, the

commercial construction of the building was completed and at that time, the Partnership issued

ten year secured mortgage bonds in respect of the commercial component of the Shaw Tower.

The bonds bear interest at 6.31% compounded semi-annually and are collateralized by the

property and the commercial rental income from the building with no recourse to the Company.

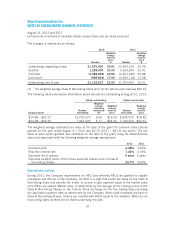

Gain on redemption of debt

In 2011, the Company assumed US $338 senior unsecured notes on acquisition of the

Canwest broadcasting business. The US $312 13.5% senior unsecured notes were originally

issued on July 3, 2008. For periods up to August 15, 2011, interest was accrued, however was

not payable until maturity unless CW Media elected to do so. As at acquisition date, US $26 of

accrued interest remained outstanding and was included in the principal debt balance with

respect to the period July 3, 2008 to February 15, 2009. Interest for all periods subsequent to

February 15, 2009 was paid in cash.

Within 30 days of closing the transaction, a subsidiary of CW Media was required to make a

change of control offer at a cash price equal to 101% of the obligations under the US $338

senior unsecured notes in accordance with a related indenture. As a result, on November 15,

2010, an offer was made to purchase all of the notes. An aggregate of US $52 face amount

was tendered under the offer and purchased by the Company for cancellation for an aggregate

price of US $59 including accrued interest and repurchase premium. In August, 2011, the

Company redeemed the remaining outstanding US $260 face amount at 106.75% as set out

under the terms of the indenture for an aggregate purchase price of US $320 including accrued

interest and prepayment premium.

The Company recorded a gain of $33 in respect of the redemption which resulted from

recognizing the remaining unamortized acquisition date fair value adjustment of $57 partially

offset by the 1% repurchase and 6.75% redemption premiums totaling $19 and $5 in respect of

the write-off of the embedded derivative instrument associated with the early prepayment option.

Debt covenants

The Company and its subsidiaries have undertaken to maintain certain covenants in respect of

the credit agreements and trust indentures described above. The Company and its subsidiaries

were in compliance with these covenants at August 31, 2012.

93