Shaw 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

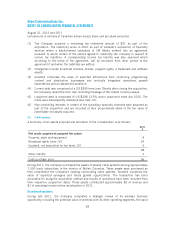

9. OTHER LONG-TERM ASSETS

2012 2011

September 1,

2010

$$ $

Equipment costs subject to a deferred revenue arrangement 278 216 202

Customer equipment financing receivables 17 9–

Credit facility arrangement fees 312

Other 33 32 29

331 258 233

Amortization provided in the accounts for 2012 amounted to $232 (2011 – $206) and was

recorded as amortization of deferred equipment costs and other amortization.

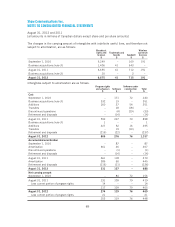

10. INTANGIBLES AND GOODWILL

Carrying amount

2012 2011

September 1,

2010

$$ $

Broadcast rights and licenses

Cable systems 4,260 4,260 4,236

DTH and satellite services 1,013 1,013 1,013

Television broadcasting 1,402 1,382 –

6,675 6,655 5,249

Program rights and advances 253 217 –

Goodwill

Non-regulated satellite services 88 88 88

Cable systems 86 86 81

Television broadcasting 541 538 –

715 712 169

Wireless spectrum licenses 191 191 191

Other intangibles

Software 195 188 156

Trademark and brands 41 41 –

236 229 156

Net book value 8,070 8,004 5,765

Broadcast rights and licenses, trademark, brands and wireless spectrum licenses have been

assessed as having indefinite useful lives. While licenses must be renewed from time to time,

the Company has never failed to do so. In addition, there are currently no legal, regulatory,

competitive or other factors that limit the useful lives of these assets.

88