Shaw 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

same substantive benefits and obligations as on Anik F1. In addition, the Company leases

a number of C-band and Ku-band transponders. Under the Ku-band F1 and F2

transponder purchase agreements, the Company is committed to paying an annual

transponder maintenance fee for each transponder acquired from the time the satellite

becomes operational for a period of 15 years.

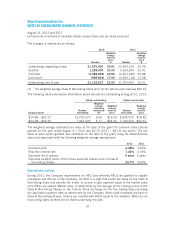

(ii) The Company has various long-term commitments of which the majority are for the

maintenance and lease of satellite transponders, program related agreements, lease of

transmission facilities, and lease of premises as follows:

$

2013 683

2014-2017 892

Thereafter 442

2,017

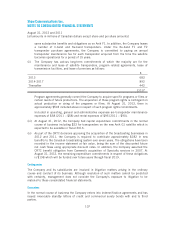

Program agreements generally commit the Company to acquire specific programs or films or

certain levels of future productions. The acquisition of these program rights is contingent on

actual production or airing of the programs or films. At August 31, 2012, there is

approximately $503 included above in respect of such program rights commitments.

Included in operating, general and administrative expenses are transponder maintenance

expenses of $58 (2011 – $58) and rental expenses of $95 (2011 – $90).

(iii) At August 31, 2012, the Company had capital expenditure commitments in the normal

course of business including $22 for transponders on the new Anik G1 satellite which is

expected to be available in fiscal 2013.

(iv) As part of the CRTC decisions approving the acquisition of the broadcasting businesses in

2012 and 2011, the Company is required to contribute approximately $182 in new

benefits to the Canadian broadcasting system over seven years. The obligations have been

recorded in the income statement at fair value, being the sum of the discounted future

net cash flows using appropriate discount rates. In addition, the Company assumed the

CRTC benefit obligation from Canwest’s acquisition of Specialty services in 2007. At

August 31, 2012, the remaining expenditure commitments in respect of these obligations

is $198 which will be funded over future years through fiscal 2019.

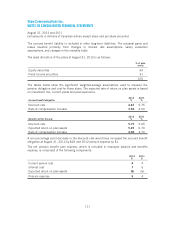

Contingencies

The Company and its subsidiaries are involved in litigation matters arising in the ordinary

course and conduct of its business. Although resolution of such matters cannot be predicted

with certainty, management does not consider the Company’s exposure to litigation to be

material to these consolidated financial statements.

Guarantees

In the normal course of business the Company enters into indemnification agreements and has

issued irrevocable standby letters of credit and commercial surety bonds with and to third

parties.

107