Shaw 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

The accrued benefit liability is included in other long-term liabilities. The actuarial gains and

losses resulted primarily from changes in interest rate assumptions, salary escalation

assumptions, and changes in the mortality table.

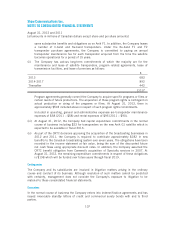

The asset allocation of the plans at August 31, 2012 is as follows:

% of plan

assets

Equity securities 69

Fixed income securities 31

100

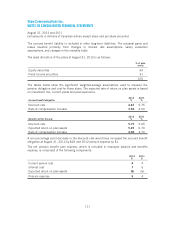

The tables below show the significant weighted-average assumptions used to measure the

pension obligation and cost for these plans. The expected rate of return on plan assets is based

on investment mix, current yields and past experience.

Accrued benefit obligation

2012

%

2011

%

Discount rate 4.67 5.75

Rate of compensation increase 3.50 4.00

Benefit cost for the year

2012

%

2011

%

Discount rate 5.75 5.65

Expected return on plan assets 5.25 6.70

Rate of compensation increase 4.00 3.70

A one percentage point decrease in the discount rate would have increased the accrued benefit

obligation at August 31, 2012 by $26 and 2012 pension expense by $1.

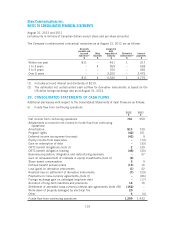

The net pension benefit plan expense, which is included in employee salaries and benefits

expense, is comprised of the following components:

2012

$

2011

$

Current service cost 44

Interest cost 76

Expected return on plan assets (6) (6)

Pension expense 54

111