Shaw 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2012

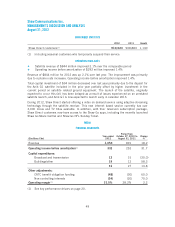

Intangibles increased $63 million due to higher program rights and advances and the broadcast

licenses recorded on the acquisition of Mystery and The Cave. Program rights and advances

(current and noncurrent) increased as advances and additional investment in acquired rights

exceeded the amortization for the current year. The increase in goodwill of $3 million is due to

the aforementioned acquisition of Mystery and The Cave.

Current liabilities were up $250 million due to increases in income taxes payable of $32

million and current portion of long-term debt of $450 million partially offset by decreases in

accounts payable and accrued liabilities of $67 million, other current liability of $161 million

and derivative instruments of $7 million. Income taxes payable increased due to the current

year provision partially offset by tax installment payments. The current portion of long-term debt

increased and long-term debt decreased due to the reclassification of the 6.1% $450 million

senior notes which were repaid at maturity on November 16, 2012. Accounts payable and

accrued liabilities decreased due to lower trade and other payables primarily in respect of

timing of payment of capital expenditures and inventory and a reduction in the current portion

of the CRTC benefit obligations. The other liability decreased due to settlement of previously

amended cross-currency interest rate agreements and derivative instruments decreased due to

settlement of contracts.

Other long-term liabilities were up $45 million due to an increase in employee benefit plans of

$71 million, primarily as a result of actuarial losses recorded in the current year, partially

reduced by a decrease in CRTC benefit obligations of $22 million.

Deferred credits were up $5 million due to an increase in deferred equipment revenue partially

offset by amortization of deferred IRU revenue.

Deferred income tax liabilities, net of deferred income tax assets, decreased $63 million due to

the current year recovery.

Shareholders’ equity increased $357 million primarily due to increases in share capital of $117

million, retained earnings of $291 million and non-controlling interests of $9 million partially

offset by an increase in accumulated other comprehensive loss of $64 million. Share capital

increased due to the issuance of 5,972,349 Class B Non-Voting Shares under the Company’s

option plan and DRIP. As of November 15, 2012, share capital is as reported at August 31,

2012 with the exception of the issuance of a total of 1,274,017 Class B Non-Voting Shares

under the DRIP and upon exercise of options under the Company’s option plan subsequent to

the year end. Retained earnings increased due to current year earnings of $728 million partially

offset by dividends of $437 million while non-controlling interests increased as their share of

earnings exceeded the distributions declared during the year. Accumulated other

comprehensive loss increased due to the actuarial losses recorded on employee benefit plans.

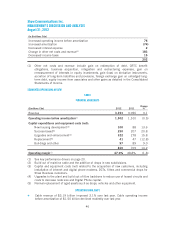

V. CONSOLIDATED CASH FLOW ANALYSIS

Operating activities

(In $millions Cdn) 2012 2011

Change

%

Funds flow from continuing operations 1,299 1,433 (9.4)

Net decrease (increase) in non-cash working capital balances

related to continuing operations 18 (192) >100.0

1,317 1,241 6.1

51