Shaw 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

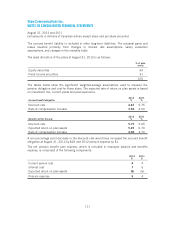

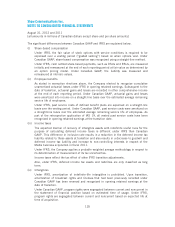

The Company’s undiscounted contractual maturities as at August 31, 2012 are as follows:

Accounts

payable and

accrued

liabilities(1)

Other

liabilities

Long-term

debt

repayable at

maturity

Derivative

instruments(2)

Interest

payments

$$$ $ $

Within one year 811 – 451 1 317

1 to 3 years – 4 969 – 528

3 to 5 years – – 700 – 456

Over 5 years – – 3,200 – 2,475

811 4 5,320 1 3,776

(1) Includes accrued interest and dividends of $219.

(2) The estimated net undiscounted cash outflow for derivative instruments is based on the

US dollar foreign exchange rate as at August 31, 2012.

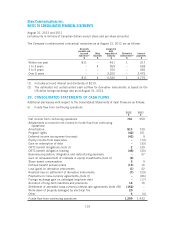

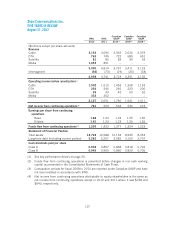

29. CONSOLIDATED STATEMENTS OF CASH FLOWS

Additional disclosures with respect to the Consolidated Statements of Cash Flows are as follows:

(i) Funds flow from continuing operations

2012 2011

$$

Net income from continuing operations 761 559

Adjustments to reconcile net income to funds flow from continuing

operations:

Amortization 813 739

Program rights (42) 101

Deferred income tax expense (recovery) (43) 9

Equity income from associates –(14)

Gain on redemption of debt –(33)

CRTC benefit obligations [note 3] 2139

CRTC benefit obligation funding (48) (30)

Business acquisition, integration and restructuring expenses –37

Gain on remeasurement of interests in equity investments [note 3] (6) –

Share-based compensation 59

Defined benefit pension plans (13) 16

Loss (gain) on derivative instruments (1) 22

Realized loss on settlement of derivative instruments (7) (29)

Payments on cross-currency agreements [note 3] –(86)

Foreign exchange gain on unhedged long-term debt –(17)

Accretion of long-term liabilities and provisions 14 15

Settlement of amended cross-currency interest rate agreements [note 28] (162) –

Write-down of property damaged by electrical fire 20 –

Other 6(4)

Funds flow from continuing operations 1,299 1,433

119