Shaw 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2012

ŠDuring 2012 the Company increased the dividend rate on Shaw’s Class A

Participating Shares and Class B Non-Voting Participating Shares to an equivalent

dividend rate of $0.9675 and $0.97 respectively. Dividends paid in 2012

increased approximately 6% over 2011 to $416 million.

ŠDuring the year the Company opened retail stores in Calgary, Vancouver and

Richmond offering a new retail experience as part of its continued investment in

defining the customer experience. The new stores showcase all of Shaw’s products

and services through a unique technology experience of interactive displays along

with hands on training and technical support.

ŠIn October 2010 Shaw completed its acquisition of the broadcasting business of

Canwest including CW Media, the company that owned the specialty channels

acquired from Alliance Atlantis Communications Inc. in 2007. The total

consideration, including debt assumed, was approximately $2.0 billion.

ŠOn December 7, 2010 the Company issued $500 million senior notes at a rate of

5.5% due December 7, 2020 and issued an additional $400 million under the

reopened 6.75% senior notes due November 9, 2039. The net proceeds from the

notes issuances were used to repay borrowings under the Company’s $1 billion

revolving credit facility.

ŠOn February 17, 2011 the Company issued an additional $400 million under the

reopened 6.75% senior notes due November 9, 2039. The net proceeds were used

for working capital and general corporate purposes as well as to partially repay

borrowings under the revolving credit facility while excess funds are held in cash

and cash equivalents.

ŠIn March 2011 Shaw implemented various cost saving initiatives including staff

reductions and a review of overhead expenses to drive efficiencies and enhance

competitiveness.

ŠOn May 31, 2011 the Company issued 12,000,000 Cumulative Redeemable Rate

Reset Preferred Shares, Series A (“Preferred Shares”) at a price of $25.00 per

Preferred Share for aggregate gross proceeds of $300 million. The net proceeds

were used for working capital and general corporate purposes while excess funds are

held in cash and cash equivalents.

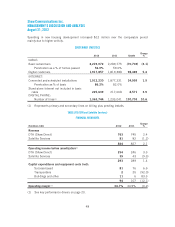

Revenue and operating expenses

Consolidated revenue of $5.00 billion for the twelve month period improved 5.4% over the prior

year. The improvement was primarily due to twelve months of revenue from Shaw Media, as well

as rate increases and growth in the Cable and Satellite divisions. Consolidated operating income

before amortization of $2.13 billion increased 3.7% over last year. The improvement was

primarily due to the current period including twelve months of Shaw Media.

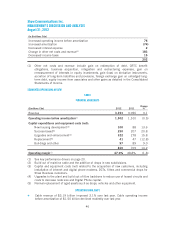

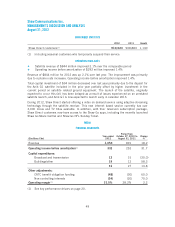

Amortization

(In $millions Cdn) 2012 2011

Change

%

Amortization revenue (expense) –

Deferred equipment revenue 115 107 7.5

Deferred equipment costs (231) (205) 12.7

Property, plant and equipment, intangibles and other (692) (637) 8.6

42