Shaw 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

Landing Lot 2 Holdings Partnership. During the current year, the category also includes a loss

of $26 related to the electrical fire and resulting water damage at the Company’s head office in

Calgary, Alberta as well as a pension curtailment gain of $25. The loss of $26 includes $6 of

costs in respect of restoration and recovery activities, including amounts incurred in the

relocation of employees, and a write-down of $20 related to the damages sustained to the

building and its contents. Insurance recoveries are expected and will be included in Other gains

as claims are approved. No insurance recoveries were recorded in 2012. The pension

curtailment gain arose due to a plan amendment to freeze salary levels.

23. INCOME TAXES

Deferred income taxes reflect the net tax effects of temporary differences between the carrying

amounts of assets and liabilities for financial reporting purposes and the amounts used for

income tax purposes. Significant components of the Company’s deferred income tax liabilities

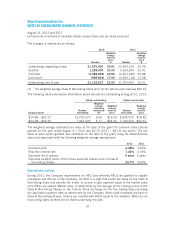

and assets are as follows:

2012

$

2011

$

September 1,

2010

$

Deferred income tax liabilities:

Property, plant and equipment and software assets 133 145 167

Broadcast rights and licenses 840 820 635

Partnership income 271 354 350

1,244 1,319 1,152

Deferred income tax assets:

Non-capital loss carryforwards 33 50 8

Accrued charges 137 132 63

Foreign exchange on long-term debt and fair value of

derivative instruments 3316

173 185 87

Net deferred income tax liabilities 1,071 1,134 1,065

Deferred income tax assets 14 30 –

Deferred income tax liabilities 1,085 1,164 1,065

102