Shaw 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

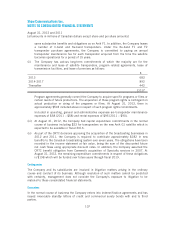

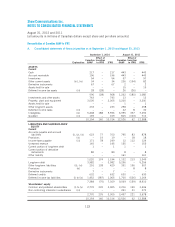

Compensation

The compensation expense of key management personnel is as follows:

2012 2011

$$

Short-term employee benefits 32 35

Post-employment pension benefits (23) 21

Retirement benefits –26

Share-based compensation 35

12 87

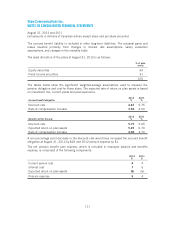

Transactions

The Company paid $3 (2011 – $4) for direct sales agent, marketing, installation and

maintenance services to a company controlled by a Director of the Company.

During the year, the Company paid $9 (2011 – $6) for remote control units to a supplier where

Directors of the Company hold positions on the supplier’s board of directors.

Loans have in the past been granted to executive officers in connection with their employment

for periods ranging up to ten years. In 2011, the remaining amount outstanding of $4 was

repaid. The effective interest rate on the interest bearing loan for 2011 was 1.0%.

Other related parties

The Company has entered into certain transactions and agreements in the normal course of

business with certain of its related parties. These transactions are measured at the exchange

amount, which is the amount of consideration established and agreed to by the related parties.

Corus Entertainment Inc. (“Corus”)

The Company and Corus are subject to common voting control. During the year, network fees of

$132 (2011 – $136), advertising fees of $2 (2011 – $1) and programming fees of $1 (2011 –

$1) were paid to various Corus subsidiaries and entities subject to significant influence. In

addition, the Company provided administrative and other services for $1 (2011 – $1), uplink of

television signals for $5 (2011 – $5) and Internet services and lease of circuits for $1 (2011 –

$1).

The Company provided Corus with television advertising spots in return for radio and television

advertising. No monetary consideration was exchanged for these transactions and no amounts

were recorded in the accounts.

Burrard Landing Lot 2 Holdings Partnership

During the year, the Company paid $10 (2011 – $10) to the Partnership for lease of office

space in Shaw Tower. Shaw Tower, located in Vancouver, BC, is the Company’s headquarters for

its Lower Mainland operations.

114