Shaw 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

On October 25, 2012, the Company declared dividends of $0.28125 per Preferred Share payable

on December 31, 2012 to holders of record at the close of business on December 14, 2012.

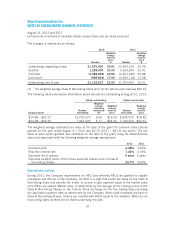

20. OTHER COMPREHENSIVE INCOME (LOSS) AND ACCUMULATED OTHER

COMPREHENSIVE INCOME (LOSS)

Components of other comprehensive income (loss) and the related income tax effects for 2012

are as follows:

Amount

$

Income taxes

$

Net

$

Adjustment for hedged items recognized in the period (3) 1 (2)

Actuarial losses on employee benefit plans (83) 21 (62)

(86) 22 (64)

Components of other comprehensive income (loss) and the related income tax effects for 2011

are as follows:

Amount

$

Income taxes

$

Net

$

Change in unrealized fair value of derivatives designated as cash

flow hedges (14) 2 (12)

Adjustment for hedged items recognized in the period 6 (2) 4

Actuarial losses on employee benefit plans (41) 11 (30)

(49) 11 (38)

Accumulated other comprehensive income (loss) is comprised of the following:

2012

$

2011

$

September 1,

2010

$

Fair value of derivatives (1) 19

Actuarial losses on employee benefit plans (92) (30) –

(93) (29) 9

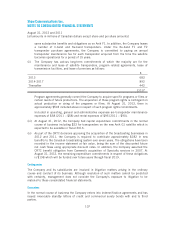

21. OPERATING, GENERAL AND ADMINISTRATIVE EXPENSES

2012

$

2011

$

Employee salaries and benefits 835 751

Purchases of goods and services 2,036 1,939

2,871 2,690

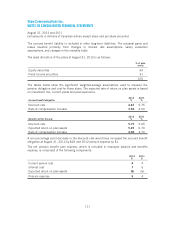

22. OTHER GAINS

Other gains generally includes realized and unrealized foreign exchange gains and losses on US

dollar denominated current assets and liabilities, gains and losses on disposal of property, plant

and equipment and minor investments, and the Company’s share of the operations of Burrard

101