Shaw 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

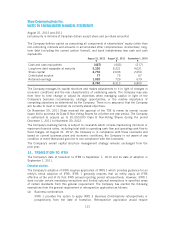

Specialty Channels

The Company holds interests in a number of specialty television channels which are subject to

either joint control or significant influence. The Company paid network fees of $6 (2011 –

$5) and provided uplink of television signals of $1 (2011 – $1) to these channels during the

year.

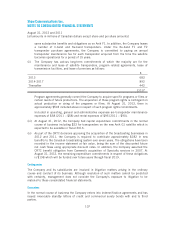

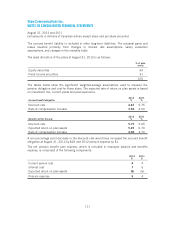

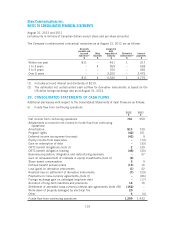

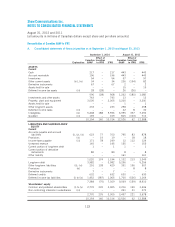

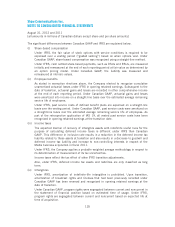

28. FINANCIAL INSTRUMENTS

Fair values

The fair value of financial instruments has been determined as follows:

(i) Current assets and current liabilities

The fair value of financial instruments included in current assets and current liabilities

approximates their carrying value due to their short-term nature.

(ii) Investment and other assets and Other long-term assets

The carrying value of investments and other assets approximates their fair value. The fair

value of long-term receivables approximates their carrying value as they are recorded at

the net present values of their future cash flows, using an appropriate discount rate.

(iii) Other current/non-current liabilities

The carrying value of the liability in respect of amended cross-currency interest rate

agreements, which fixed the settlement of the principal portion of the liability on

December 15, 2011, was at amortized cost based on an estimated mark-to-market

valuation at the date of amendment. The fair value of this liability was determined using

an estimated mark-to-market valuation. The fair value of program rights payable,

estimated by discounting future cash flows, approximates their carrying value.

(iv) Long-term debt

The carrying value of long-term debt is at amortized cost based on the initial fair value as

determined at the time of issuance or at the time of a business acquisition. The fair

value of publicly traded notes is based upon current trading values. Other notes and

debentures are valued based upon current trading values for similar instruments.

(v) Derivative financial instruments

The fair value of cross-currency interest rate exchange agreements and US currency

forward purchase contracts is determined using an estimated credit-adjusted

mark-to-market valuation.

115