Shaw 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2012

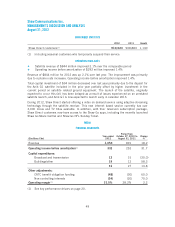

lower operating income before amortization of $66 million and increased income tax expense of

$31 million. The fourth quarter also included a loss of $26 million in respect of the electrical

fire at the Company’s head office offset by a pension curtailment gain of $25 million. In the

third quarter of 2012, net income increased by $70 million due to higher operating income

before amortization of $74 million and lower amortization of $9 million partially offset by

increased income tax expense of $17 million. In the second quarter of 2012, net income

decreased by $24 million due to a decline in operating income before amortization of $73

million partially offset by lower income tax expense of $53 million. Net income increased by

$118 million in the first quarter of 2012 due to the combined impact of higher operating

income before amortization of $85 million and income tax expense of $18 million in the first

quarter and the loss from discontinued operations of $84 million and gain on redemption of

debt of $23 million recorded in the preceding quarter. The first and second quarters of 2011

were impacted by the Media acquisition. As a result, net income increased $153 million in the

second quarter of 2011 due to the impact of the CRTC benefit obligation of $139 million and

acquisition, integration and restructuring costs of $58 million recorded in the first quarter and

higher operating income before amortization and foreign exchange gain on unhedged long-term

debt in the second quarter, the total of which was partially offset by increases in interest

expense, loss on derivative instruments and income tax expense. During the third quarter of

2011 net income increased by $32 million due to higher operating income before amortization

and a lower loss on derivative instruments partially offset by increased income taxes, a lower

foreign exchange gain on unhedged long-term debt and the impact of the restructuring

activities undertaken by the Company. In the fourth quarter of 2011 net income declined $117

million due to lower operating income before amortization of $105 million and the loss of $83

million in respect of the wireless discontinued operations partially offset by the gain on

redemption of debt and the aforementioned restructuring activities in the previous quarter. As a

result of the aforementioned changes in net income, basic and diluted earnings per share have

trended accordingly.

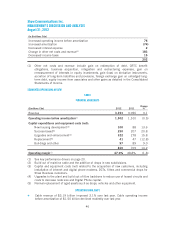

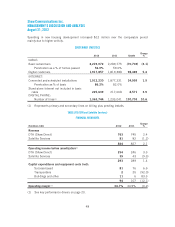

The following further assists in explaining the trend of quarterly revenue and operating income

before amortization:

Growth in subscriber statistics as follows:

2012 2011

Subscriber Statistics First Second Third Fourth First Second Third Fourth

Basic cable customers (22,768) (9,946) (21,515) (16,474) (7,542) (13,662) (13,577) (16,207)

Digital customers 59,566 46,564 246 (7,907) 62,216 35,403 19,202 49,548

Internet customers 10,685 18,681 (429) 6,062 18,752 10,772 11,165 13,528

Digital Phone lines 22,969 54,407 29,142 24,185 49,842 32,512 31,404 22,776

DTH customers 531 1,274 (1,820) 1,155 (1,539) 2,176 1,644 806

40