Shaw 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

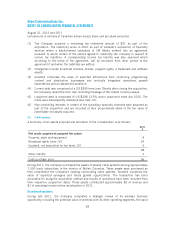

A summary of net assets acquired and allocation of consideration is as follows:

$

Net assets acquired at assigned fair values

Cash 6

Accounts receivable 4

Other current assets(1) 4

Intangibles(2) [note 10] 28

Goodwill, not deductible for tax(3) [note 10] 3

45

Current liabilities 3

Deferred income taxes 2

40

(1) Other current assets is comprised of program rights.

(2) Intangibles include broadcast licenses and program rights.

(3) Goodwill comprises the value of expected efficiencies and synergies from integrating the

operations with the Company’s other wholly-owned specialty channels.

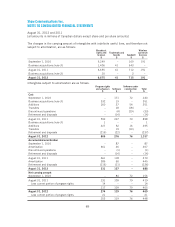

2011

(i) Television broadcasting businesses

Cash(1)

$

Cumulative

equity

income

$

Total

$

Television broadcasting businesses 1,208 2 1,210

(1) The cash consideration includes $708 paid in 2010 for the Company’s initial equity

investment in CW Investments Co. (“CW Media”) and an option to acquire an additional

equity interest. The acquisition-date fair value of the Company’s initial equity investment

approximated $549 compared to its carrying value of $558 under the equity method of

accounting which resulted in an amount of approximately $9 related to transaction costs

which are included in business acquisition, integration and restructuring expenses in the

income statement.

On May 3, 2010 the Company announced that it had entered into agreements to acquire

100% of the broadcasting businesses of Canwest Global Communications Corp. (“Canwest”).

The acquisition includes all of the over-the-air channels, which were in creditor protection,

and the specialty television business of Canwest, including Canwest’s equity interest in CW

Media, the company that owns the portfolio of specialty channels acquired from Alliance

Atlantis Communications Inc. in 2007. During 2010, the Company completed certain

portions of the acquisition including acquiring a 49.9% equity interest, a 29.9% voting

interest, and an option to acquire an additional 14.8% equity interest and 3.4% voting

interest in CW Media. On October 22, 2010, the CRTC approved the transaction and the

Company closed the purchase on October 27, 2010. Certain of the subsidiary specialty

channels continue to have non-controlling interests. The purpose of the acquisition is to

81