Shaw 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

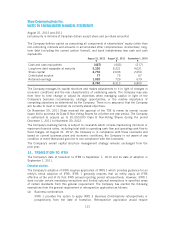

Other benefit plans

As part of the broadcasting business acquisition in fiscal 2011, the Company assumed post

employment benefits plans that provide post retirement health and life insurance coverage.

2012

$

2011

$

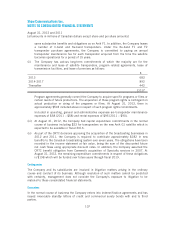

Accrued benefit obligation, beginning of year 15 –

Media business acquisition –15

Current service cost 1–

Interest cost 11

Plan amendment –(1)

Actuarial loss 3–

Payment of benefits to employees (1) –

Accrued benefit obligation and plan deficit, end of year 19 15

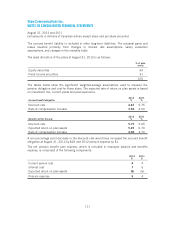

Reconciliation of accrued benefit obligation to Consolidated Statement of Financial Position

accrued benefit liability

2012

$

2011

$

Balance of unamortized obligation:

Plan amendment –(1)

Accrued post-retirement liability recognized in Consolidated Statement of

Financial Position:

Other long-term liabilities 19 16

Accrued benefit obligation, end of year as above 19 15

The table below shows the components of the post-retirement benefit plan expense. The net

post-retirement benefit plan expense, which is included in employee salaries and benefits

expense, is comprised of the following components:

2012 2011

$$

Current service cost 1–

Interest cost 11

Plan amendment (1) –

Post-retirement expense 11

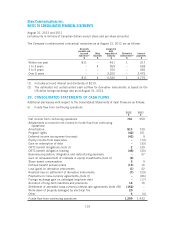

The discount rates used to measure the post-retirement benefit cost for the year and the

accrued benefit obligation as at August 31, 2012 were 5.50% and 4.50%, respectively (2011

– 5.50% and 5.50%, respectively). The assumed health care cost trend rate for the next year

used to measure expected benefit costs is 6.39% decreasing to an ultimate rate of 4.58% in

2029. A one percentage point increase in the assumed health care cost trend rate would have

increased the service and interest costs and accrued obligation by $nil and $3, respectively. A

one percentage point decrease in the assumed health care cost trend rate would have lowered

the service and interest costs and accrued obligation by $nil and $3, respectively.

112