Shaw 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

amortization. The discount rates used in the analysis are based on the Company’s weighted

average cost of capital and an assessment of the risk inherent in the projected cash flows. In

analyzing the FVLCS determined by the DCF analysis the Company also considers a market

approach determining a recoverable amount for each unit and total entity value determined

using a market capitalization approach. Recent market transactions are taken into account,

when available. The key assumptions used to determine the recoverable amounts, including a

sensitivity analysis, are included in note 10.

(v) Employee benefit plans

The amounts reported in the financial statements relating to the defined benefit pension plans

are determined using actuarial valuations that are based on several assumptions including the

discount rate, rate of compensation increase and the expected return on plan assets (for funded

plans). While the Company believes these assumptions are reasonable, differences in actual

results or changes in assumptions could affect employee benefit obligations and the related

income statement impact. The most significant assumption used to calculate the net employee

benefit plan expense is the discount rate. The discount rate is the interest rate used to

determine the present value of the future cash flows that is expected will be needed to settle

employee benefit obligations. It is based on the yield of long-term, high-quality corporate fixed

income investments closely matching the term of the estimated future cash flows and is

determined at the end of every year.

(vi) Income taxes

The Company is required to estimate income taxes using substantively enacted tax rates and

laws that will be in effect when the differences are expected to reverse. In determining the

measurement of tax uncertainties, the Company applies a probable weighted average

methodology. Realization of deferred income tax assets is dependent on generating sufficient

taxable income during the period in which the temporary differences are deductible. Although

realization is not assured, management believes it is more likely than not that all recognized

deferred income tax assets will be realized based on reversals of deferred income tax liabilities,

projected operating results and tax planning strategies available to the Company and its

subsidiaries.

(vii) Contingencies

The Company is subject to various claims and contingencies related to lawsuits, taxes and

commitments under contractual and other commercial obligations. Contingent losses are

recognized by a charge to income when it is likely that a future event will confirm that an asset

has been impaired or a liability incurred at the date of the financial statements and the amount

can be reasonably estimated. Significant changes in assumptions as to the likelihood and

estimates of the amount of a loss could result in recognition of additional liabilities.

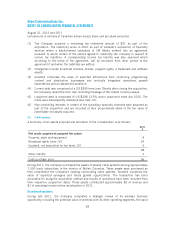

Critical judgements

The following are critical judgements apart from those involving estimation:

(i) Determination of a CGU

Management’s judgement is required in determining the Company’s cash generating units for

the impairment assessment of its indefinite-life intangible assets. The CGUs have been

determined considering operating activities and asset management and are consistent with the

Company’s reporting segments, Cable, DTH and Satellite Services and Media.

78