Shaw 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

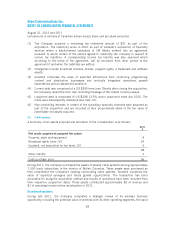

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

combined instrument or contract is not measured at fair value. The Company records embedded

derivatives at fair value with changes recognized in the income statement as loss/gain on

derivative instruments.

Fair value measurements

Fair value estimates are made at a specific point in time, based on relevant market information

and information about the financial instrument. These estimates are subjective in nature and

involve uncertainties and matters of significant judgement and, therefore, cannot be

determined with precision. Changes in assumptions could significantly affect the estimates.

The fair value hierarchy is based on inputs to valuation techniques that are used to measure fair

value that are either observable or unobservable. Observable inputs reflect assumptions market

participants would use in pricing an asset or liability based on market data obtained from

independent sources while unobservable inputs reflect a reporting entity’s pricing based upon

their own market assumptions.

The fair value hierarchy consists of the following three levels:

Level 1 Inputs are quoted prices in active markets for identical assets or liabilities.

Level 2 Inputs for the asset or liability are based on observable market data, either directly or

indirectly, other than quoted prices.

Level 3 Inputs for the asset or liability that are not based on observable market data.

Employee benefits

The Company accrues its obligations and related costs under its employee benefit plans, net of

plan assets. The cost of pensions and other retirement benefits earned by certain employees is

actuarially determined using the projected benefit method pro-rated on service and

management’s best estimate of expected plan investment performance, salary escalation and

retirement ages of employees. For purposes of calculating the expected return on plan assets,

those assets are valued at fair value. Past service costs from plan initiation and amendments

are recognized immediately in the income statement to the extent they are vested. Unvested

past service costs are amortized on a straight-line basis over the expected average remaining

vesting period. Negative plan amendments which reduce costs are applied to reduce any

existing unamortized past service costs. The excess, if any, is amortized over the expected

average remaining vesting period. Actuarial gains or losses occur because assumptions about

benefit plans relate to a long time frame and differ from actual experiences. These assumptions

are revised based on actual experience of the plans such as changes in discount rates, expected

return on plan assets, expected retirement ages and projected salary increases. Actuarial gains

(losses) are recognized in other comprehensive income (loss) on an annual basis, at a

minimum, and on an interim basis when there are significant changes in assumptions.

Curtailment gains arising from amendments to the terms of a defined benefit plan such that a

significant element of future service by current employees will no longer qualify for benefits, or

will only qualify for reduced benefits, are recognized in the period in which they occur. When

the restructuring of a benefit plan gives rise to both a curtailment and a settlement of

obligations, the curtailment is accounted for prior to the settlement.

75