Shaw 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2012

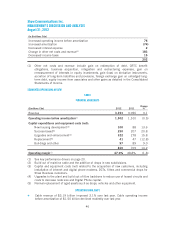

Funds flow from continuing operations decreased over the comparative year as higher operating

income before amortization adjusted for non-cash program rights expenses in the current year

and charges in the prior year for termination of swap contracts and business acquisition,

integration and restructuring expenses were more than offset by the combined impact of the

settlement of the amended cross-currency interest rate agreements as well as increased current

income taxes, program rights purchases and CRTC benefit obligation funding in the current

year. The net change in non-cash working capital balances related to continuing operations

fluctuated over the comparative period due to fluctuations in accounts receivable and the

timing of payment of current income taxes payable and accounts payable and accrued

liabilities.

Investing activities

(In $millions Cdn) 2012 2011 Decrease

Cash flow used in investing activities (983) (1,350) 367

Cash requirements for investing activities decreased over the comparable year due to amounts

paid to complete the Media business acquisition in 2011 and fluctuations in inventory levels

partially offset by the higher capital expenditures in the current year.

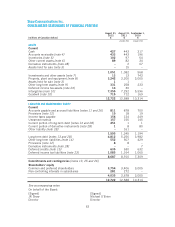

Financing activities

The changes in financing activities during 2012 and 2011 were as follows:

(In $millions Cdn) 2012 2011

Bank credit facility arrangement costs (4) –

Issuance of Cdn $500 million 5.50% senior notes –498

Issuance of Cdn $800 million 6.75% senior notes –779

Issuance of Preferred Shares –300

Senior notes and Preferred Shares issuance costs (17)

Repayment of CW Media US $390 million term loan (395)

Redemption of CW Media US $338 million 13.5% senior notes (334)

Dividends (333) (352)

Distributions paid to non-controlling interests (26) (22)

Senior notes prepayment premium –(19)

Issuance of Class B Non-Voting Shares 17 46

Repayment of Partnership debt (1) (1)

Cash flow provided by financing activities (347) 483

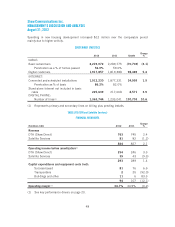

VI. LIQUIDITY AND CAPITAL RESOURCES

In the current year, the Company generated $482 million of free cash flow. Shaw used its free

cash flow along with cash of $16 million, proceeds on issuance of Class B Non-Voting Shares of

$17 million and other net items of $25 million to pay common share dividends of $318

million, fund the $162 million on settlement of amended cross-currency interest rate

agreements, invest an additional net $42 million in program rights and purchase the remaining

interests in two specialty channels for $18 million.

52