Shaw 2012 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

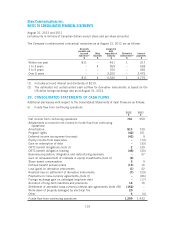

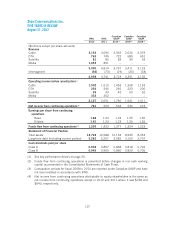

B. Consolidated statements of income and comprehensive income for the year ended August 31, 2011

Explanation

Canadian

GAAP

Effect of

transition

to IFRS IFRS

Revenue 4,741 – 4,741

Operating, general and administrative expenses (i), (ii) 2,710 (20) 2,690

Operating income before amortization 2,031 20 2,051

Amortization:

Deferred equipment revenue 107 – 107

Deferred equipment costs (205) – (205)

Property, plant and equipment, intangibles and other (637) – (637)

Operating income 1,296 20 1,316

Amortization of financing costs – long-term debt (4) – (4)

Interest expense (332) – (332)

Gain on redemption of debt 33 – 33

CRTC benefit obligation (139) – (139)

Business acquisition, integration and restructuring expenses (91) – (91)

Loss on derivative instruments (22) – (22)

Accretion of long-term liabilities and provisions (15) – (15)

Foreign exchange gain on unhedged long-term debt 17 – 17

Equity income from associates 14 – 14

Other gains 11 – 11

Income before income taxes 768 20 788

Current income tax expense (iii) 210 10 220

Deferred income tax expense (recovery) (i) to (iii) (5) 14 9

Net income from continuing operations 563 (4) 559

Loss from discontinued operations (89) – (89)

Net income 474 (4) 470

Other comprehensive income (loss)

Change in unrealized fair value of derivatives designated as cash flow

hedges (12) – (12)

Adjustment for hedged items recognized in the period 4 – 4

Actuarial losses on employee benefit plans (ii) – (30) (30)

(8) (30) (38)

Comprehensive income 466 (34) 432

Net income attributable to:

Equity shareholders 455 (4) 451

Non-controlling interests in subsidiaries 19 – 19

474 (4) 470

Comprehensive income attributable to:

Equity shareholders 447 (34) 413

Non-controlling interests in subsidiaries 19 – 19

466 (34) 432

Earnings per share – basic and diluted

Earnings per share from continuing operations 1.24 (0.01) 1.23

Loss per share from discontinued operations (0.21) – (0.21)

Earnings per share 1.03 (0.01) 1.02

124