Shaw 2012 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

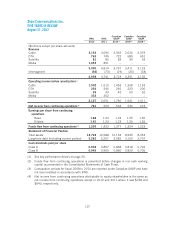

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

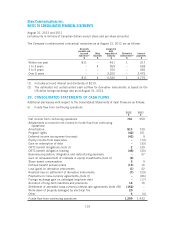

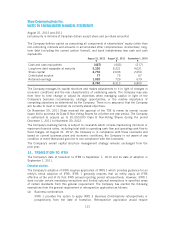

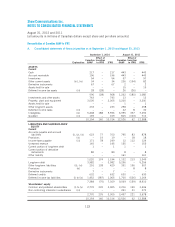

The significant differences between Canadian GAAP and IFRS are explained below.

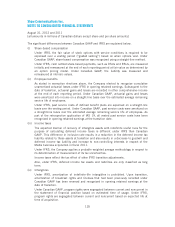

(i) Share-based compensation

Under IFRS, the fair value of stock options with service conditions is required to be

expensed over a vesting period (“graded vesting”) based on when options vest. Under

Canadian GAAP, share-based compensation was recognized using a straight-line method.

Under IFRS, cash settled share-based payments, such as DSUs and RSUs, are measured

initially and remeasured at the end of each reporting period at fair value as determined by

an option pricing model. Under Canadian GAAP, the liability was measured and

remeasured at intrinsic values.

(ii) Employee benefits

As stated in exemption elections above, the Company elected to recognize cumulative

unamortized actuarial losses under IFRS in opening retained earnings. Subsequent to the

date of transition, actuarial gains and losses are recorded in other comprehensive income

at the end of each reporting period. Under Canadian GAAP, actuarial gains and losses

were amortized into income on a straight-line basis over the estimated average remaining

service life of employees.

Under IFRS, past service costs of defined benefit plans are expensed on a straight-line

basis over the vesting period. Under Canadian GAAP, past service costs were amortized on

a straight-line basis over the estimated average remaining service life of employees. As

part of the retrospective application of IAS 19, all vested past service costs have been

recognized in opening retained earnings at the transition date.

(iii) Income taxes

The expected manner of recovery of intangible assets with indefinite useful lives for the

purpose of calculating deferred income taxes is different under IFRS than Canadian

GAAP. This difference in inclusion rate results in a reduction in the deferred income tax

liability related to these assets at transition and also results in a decrease to goodwill and

deferred income tax liability and increase to non-controlling interests in respect of the

Media business acquisition in fiscal 2011.

Under IFRS, the Company applies a probable weighted average methodology in respect to

its determination of measurement of its tax uncertainties.

Income taxes reflect the tax effect of other IFRS transition adjustments.

Also, under IFRS, deferred income tax assets and liabilities are only classified as long

term.

(iv) Intangibles

Under IFRS, amortization of indefinite-life intangibles is prohibited. Upon transition,

amortization of broadcast rights and licenses that had been previously recorded under

Canadian GAAP has been reversed and recognized in opening retained earnings at the

date of transition.

Under Canadian GAAP, program rights were segregated between current and noncurrent in

the statement of financial position based on estimated time of usage. Under IFRS,

program rights are segregated between current and noncurrent based on expected life at

time of acquisition.

125