Shaw 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

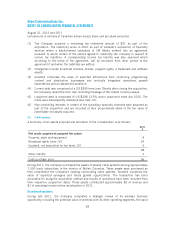

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

Actual results could differ from those estimates and significant changes in assumptions could

cause an impairment in assets. The following require the most difficult, complex or subjective

judgements which result from the need to make estimates about the effects of matters that are

inherently uncertain.

Estimation uncertainty

The following are key assumptions concerning the future and other key sources of estimation

uncertainty that could impact the carrying amount of assets and liabilities and results of

operations in future periods:

(i) Allowance for doubtful accounts

The Company is required to make an estimate of an appropriate allowance for doubtful

accounts on its receivables. The estimated allowance required is a matter of judgement and the

actual loss eventually sustained may be more or less than the estimate, depending on events

which have yet to occur and which cannot be foretold, such as future business, personal and

economic conditions.

(ii) Property, plant and equipment

The Company is required to estimate the expected useful lives of its property, plant and

equipment. These estimates of useful lives involve significant judgement. In determining these

estimates, the Company takes into account industry trends and company-specific factors,

including changing technologies and expectations for the in-service period of these assets.

Management’s judgement is also required in determination of the amortization method, the

residual value of assets and the capitalization of labour and overhead.

(iii) Business combinations – purchase price allocation

Purchase price allocations involve uncertainty because management is required to make

assumptions and judgements to estimate the fair value of the identifiable assets acquired and

liabilities assumed in business combinations. Fair value estimates are based on quoted market

prices and widely accepted valuation techniques, including discounted cash flow (“DCF”)

analysis. Such estimates include assumptions about inputs to the valuation techniques,

industry economic factors and business strategies.

(iv) Impairment

The Company estimates the recoverable amount of its CGUs using a FVLCS calculation based

on a DCF analysis. Significant judgements are inherent in this analysis including estimating the

amount and timing of the cash flows attributable to the broadcast rights and licenses and the

AWS licenses, the selection of an appropriate discount rate, and the identification of

appropriate terminal growth rate assumptions. In this analysis the Company estimates the

discrete future cash flows associated with the intangible asset for five years and determines a

terminal value. The future cash flows are based on the Company’s estimates of future operating

results, economic conditions and the competitive environment. The terminal value is estimated

using both a perpetuity growth assumption and a multiple of operating income before

77