Shaw 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

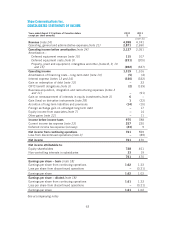

Shaw Communications Inc.

CONSOLIDATED STATEMENTS OF INCOME

Years ended August 31 [millions of Canadian dollars

except per share amounts]

2012

$

2011

$

[note 31]

Revenue [note 24] 4,998 4,741

Operating, general and administrative expenses [note 21] 2,871 2,690

Operating income before amortization [note 24] 2,127 2,051

Amortization –

Deferred equipment revenue [note 15] 115 107

Deferred equipment costs [note 9] (231) (205)

Property, plant and equipment, intangibles and other [notes 8, 9, 10

and 15] (692) (637)

Operating income 1,319 1,316

Amortization of financing costs – long-term debt [note 13] (5) (4)

Interest expense [notes 13 and 24] (330) (332)

Gain on redemption of debt [note 13] –33

CRTC benefit obligations [note 3] (2) (139)

Business acquisition, integration and restructuring expenses [notes 3

and 11] –(91)

Gain on remeasurement of interests in equity investments [note 3] 6–

Gain (loss) on derivative instruments [note 28] 1(22)

Accretion of long-term liabilities and provisions (14) (15)

Foreign exchange gain on unhedged long-term debt –17

Equity income from associates [note 7] –14

Other gains [note 22] –11

Income before income taxes 975 788

Current income tax expense [note 23] 257 220

Deferred income tax expense (recovery) (43) 9

Net income from continuing operations 761 559

Loss from discontinued operations [note 3] –(89)

Net income 761 470

Net income attributable to:

Equity shareholders 728 451

Non-controlling interests in subsidiaries 33 19

761 470

Earnings per share – basic [note 18]

Earnings per share from continuing operations 1.62 1.23

Loss per share from discontinued operations –(0.21)

Earnings per share 1.62 1.02

Earnings per share – diluted [note 18]

Earnings per share from continuing operations 1.61 1.23

Loss per share from discontinued operations –(0.21)

Earnings per share 1.61 1.02

See accompanying notes

63