Shaw 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2012

optimal leverage for the Corporation in the current environment. Should the ratio fall below this

the Board may choose to recapitalize back into this optimal range. The Board may also

determine to increase the Corporation’s debt above these levels to finance specific strategic

opportunities such as a significant acquisition or repurchase of Class B Non-Voting

Participating Shares in the event that pricing levels were to drop precipitously.

Off-balance sheet arrangement and guarantees

Guarantees

Generally it is not the Company’s policy to issue guarantees to non-controlled affiliates or third

parties; however, it has entered into certain agreements as more fully described in Note 25 to

the Consolidated Financial Statements. As disclosed thereto, Shaw believes it is remote that

these agreements would require any cash payment.

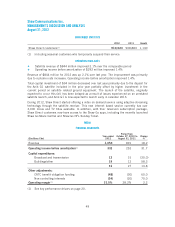

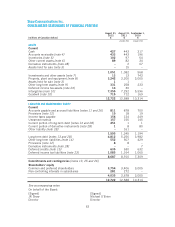

Contractual obligations

The amounts of estimated future payments under the Company’s contractual obligations at

August 31, 2012 are detailed in the following table.

CONTRACTUAL OBLIGATIONS

Payments due by period

(In $millions Cdn) Total

Within

1 year 2 – 3 years 4 – 5 years

More than

5 years

Long-term debt(1) 9,096 768 1,497 1,156 5,675

Operating obligations(2) 2,017 683 617 275 442

Purchase obligations(3) 88 88 – – –

Other long-term obligations(4) 77 – – –

11,208 1,546 2,114 1,431 6,117

(1) Includes principal repayments and interest payments.

(2) Includes maintenance and lease of satellite transponders, program related agreements,

lease of transmission facilities and lease of premises.

(3) Includes capital expenditure and inventory purchase commitments.

(4) Includes other financial liabilities and are primarily in respect of program rights.

VII. ADDITIONAL INFORMATION

Additional information relating to Shaw, including the Company’s Annual Information Form

dated November 29, 2012, can be found on SEDAR at www.sedar.com.

VIII. COMPLIANCE WITH NYSE CORPORATE GOVERNANCE LISTING STANDARDS

Disclosure of the Company’s corporate governance practices which differ from the New York

Stock Exchange (“NYSE”) corporate governance listing standards are posted on Shaw’s website,

www.shaw.ca (under Investors/Corporate Governance/Compliance with NYSE Corporate

Governance Listing Standards).

54