Shaw 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134

|

|

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2012

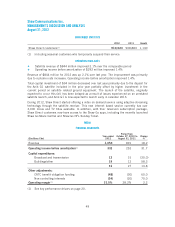

Spending in new housing development increased $12 million over the comparable period

mainly due to higher activity.

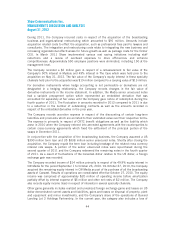

SUBSCRIBER STATISTICS

2012 2011 Growth

Change

%

CABLE:

Basic subscribers 2,219,072 2,289,775 (70,703) (3.1)

Penetration as a % of homes passed 56.0% 59.0%

Digital customers 1,917,857 1,819,388 98,469 5.4

INTERNET:

Connected and scheduled installations 1,912,230 1,877,231 34,999 1.9

Penetration as % of basic 86.2% 82.0%

Stand-alone Internet not included in basic

cable 225,639 217,068 8,571 3.9

DIGITAL PHONE:

Number of lines(1) 1,363,744 1,233,041 130,703 10.6

(1) Represents primary and secondary lines on billing plus pending installs.

SATELLITE (DTH and Satellite Services)

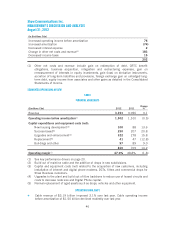

FINANCIAL HIGHLIGHTS

($millions Cdn) 2012 2011

Change

%

Revenue

DTH (Shaw Direct) 763 745 2.4

Satellite Services 81 82 (1.2)

844 827 2.1

Operating income before amortization(1)

DTH (Shaw Direct) 254 246 3.3

Satellite Services 39 43 (9.3)

293 289 1.4

Capital expenditures and equipment costs (net):

Success-based 81 76 6.6

Transponders 225 (92.0)

Buildings and other 11 6 83.3

94 107 (12.1)

Operating margin(1) 34.7% 34.9% (0.2)

(1) See key performance drivers on page 20.

48