Shaw 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

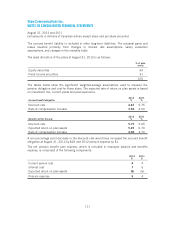

24. BUSINESS SEGMENT INFORMATION

The Company’s operating segments are Cable, Media, DTH and Satellite Services, all of which

are substantially located in Canada. The accounting policies of the segments are the same as

those described in the summary of significant accounting policies. Management evaluates

divisional performance based on revenue and operating income before charges such as

amortization.

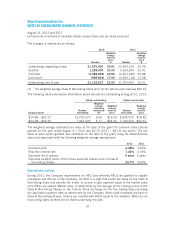

2012

Satellite

Cable

$

Media

$

DTH

$

Satellite

Services

$

Total

$

Intersegment

eliminations

$

Total

$

Revenue 3,193 1,053 763 81 844 (92) 4,998

Operating income before amortization 1,502 332 254 39 293 – 2,127

Operating income as % of revenue 47.0% 31.5% 33.3% 48.1% 34.7% – 42.6%

Interest(1) 329

Burrard Landing Lot 2 Holdings Partnership 1

330

Cash taxes(1) 282

Corporate/other (25)

257

Capital expenditures and equipment costs (net) by

segment

Capital expenditures 729 31 3 8 11 – 771

Equipment costs (net) 81 – 83 – 83 – 164

810 31 86 8 94 – 935

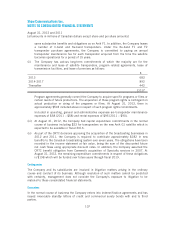

Reconciliation to Consolidated Statements of Cash

Flows

Additions to property, plant and equipment 730

Additions to equipment costs (net) 178

Additions to other intangibles 65

Total of capital expenditures and equipment costs

(net) per Consolidated Statements of Cash Flows 973

Increase in working capital related to capital

expenditures (10)

Increase in customer equipment financing receivables (16)

Less: Proceeds on disposal of property, plant and

equipment (9)

Less: Satellite services equipment profit(2) (3)

Total capital expenditures and equipment costs (net)

reported by segments 935

See notes following 2011 business segment table.

105