Shaw 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

Employees are not required to contribute to this plan and there are no minimum required

employer contributions under the plan. Subsequent to year end, the plan became partially

funded as the Company made discretionary contributions of $300 to a Retirement

Compensation Arrangement Trust.

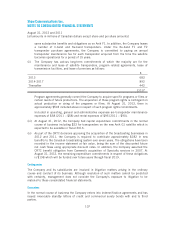

The table below shows the change in benefit obligation for this plan.

2012

$

2011

$

Accrued benefit obligation and plan deficit, beginning of year 334 275

Current service cost 76

Past service cost ––

Interest cost 19 16

Curtailment gain (25) –

Actuarial losses 52 43

Payment of benefits to employees (9) (6)

Accrued benefit obligation and plan deficit, end of year 378 334

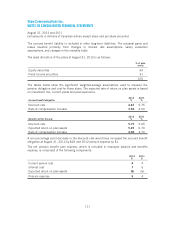

Reconciliation of accrued benefit obligation to

Consolidated Statement of Financial Position accrued benefit liability

2012

$

2011

$

Balance of unamortized pension obligation:

Past service costs 11

Accrued pension benefit liability recognized in Consolidated Statement of

Financial Position:

Accounts payable and accrued liabilities 99

Other long-term liabilities 368 324

377 333

Accrued benefit obligation, end of year as above 378 334

The actuarial losses resulted primarily from changes in interest rate assumptions, salary

escalation assumptions, and changes in the mortality table.

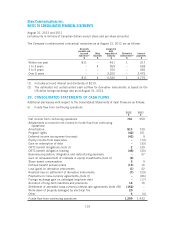

The tables below show the significant weighted-average assumptions used to measure the

pension obligation and cost for this plan.

Accrued benefit obligation

2012

%

2011

%

Discount rate 4.50 5.50

Rate of compensation increase 5.00(1) 5.00

Benefit cost for the year

2012

%

2011

%

Discount rate 5.50 5.75

Rate of compensation increase 5.00 5.00

(1) Applies only to incentive compensation component of eligible pensionable earnings.

109