Shaw 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

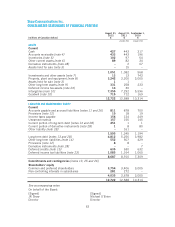

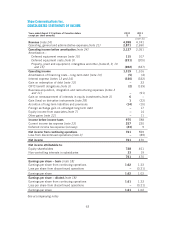

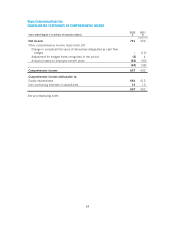

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

1. CORPORATE INFORMATION

Shaw Communications Inc. (the “Company”) is a diversified Canadian communications

company whose core operating business is providing broadband cable television services,

Internet, Digital Phone and telecommunications services (“Cable”); Direct-to-home (“DTH”)

satellite services (Shaw Direct) and satellite distribution services (“Satellite Services”); and

programming content (through Shaw Media).

The Company was incorporated under the laws of the Province of Alberta on December 9, 1966

under the name Capital Cable Television Co. Ltd. and was subsequently continued under the

Business Corporations Act (Alberta) on March 1, 1984 under the name Shaw Cablesystems Ltd.

Its name was changed to Shaw Communications Inc. on May 12, 1993. The Company’s shares

are listed on the Toronto and New York Stock Exchanges. The registered office of the Company

is located at Suite 900, 630 – 3rd Avenue S.W., Calgary, Alberta, Canada T2P 4L4.

2. BASIS OF PRESENTATION AND ACCOUNTING POLICIES

Statement of compliance

These consolidated financial statements of the Company have been prepared in accordance

with International Financial Reporting Standards (“IFRS”) as issued by the International

Accounting Standards Board (“IASB”). These are the first annual financial statements prepared

under IFRS and IFRS 1 First-time Adoption of International Financial Reporting Standards

(“IFRS 1”) has been applied. An explanation of how the transition to IFRS has affected the

Company’s consolidated financial statements is provided in note 31.

The consolidated financial statements of the Company for the years ended August 31, 2012

and 2011 and as at September 1, 2010, were approved by the Board of Directors and

authorized for issue on November 29, 2012.

Basis of presentation

These consolidated financial statements have been prepared primarily under the historical cost

convention and are expressed in millions of Canadian dollars unless otherwise indicated. Other

measurement bases used are outlined in the applicable notes below. The consolidated

statements of income are presented using the nature classification for expenses.

Basis of consolidation

The consolidated financial statements include the accounts of the Company and those of its

subsidiaries. Intercompany transactions and balances are eliminated on consolidation. The

results of operations of subsidiaries acquired during the period are included from their

respective dates of acquisition.

The accounts also include the Company’s proportionate share of the assets, liabilities,

revenues, and expenses of its interests in joint ventures which includes a 33.33% interest in

the Burrard Landing Lot 2 Holdings Partnership and 50% interest in several specialty television

channels.

67