Shaw 2012 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

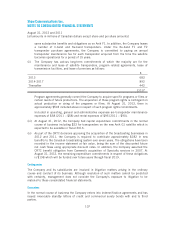

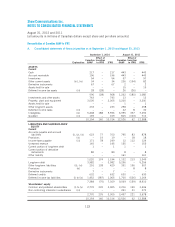

The carrying values and estimated fair values of long-term debt, other liabilities and derivative

financial instruments are as follows:

August 31, 2012 August 31, 2011 September 1, 2010

Carrying

value

Estimated

fair value

Carrying

value

Estimated

fair value

Carrying

value

Estimated

fair value

$$$$$$

Assets

Derivative financial instruments –

Cross-currency interest rate

exchange agreements(1) ––– – 57 57

US currency forward purchase

contracts(1) ––2 2 10 10

––2 2 67 67

Liabilities

Other current/non-current liability ––161 162 159 160

Long-term debt 5,263 5,753 5,257 5,542 3,983 4,353

Derivative financial instruments –

US currency forward purchase

contracts(1) 11––––

Cross-currency interest rate

exchange agreements(1) ––8 8 87 87

5,264 5,754 5,426 5,712 4,229 4,600

(1) Level 2 fair value – determined by valuation techniques using inputs based on observable

market data, either directly or indirectly, other than quoted prices.

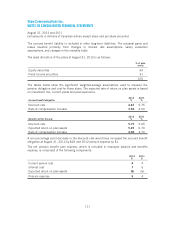

Derivative financial instruments held at August 31, 2012 have maturity dates throughout fiscal

2013.

As at August 31, 2012 and 2011 and September 1, 2010, US currency forward purchase

contracts qualified as hedging instruments and were designated as cash flow hedges. The cross-

currency interest rate exchange agreements did not qualify as hedging instruments as the

underlying hedged US denominated debt was repaid during 2010.

Upon redemption of US $300 7.2% senior notes in 2010, the Company entered into amended

agreements with the counterparties of the cross-currency agreements to fix the settlement of

the principal liability on December 15, 2011 at $162. At August 31, 2011, the carrying

amount of the liability was $161 (September 1, 2010 – $159).

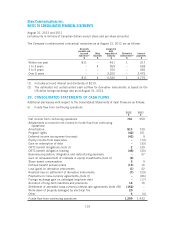

Risk management

The Company is exposed to various market risks including currency risk and interest rate risk,

as well as credit risk and liquidity risk associated with financial assets and liabilities. The

Company has designed and implemented various risk management strategies, discussed further

below, to ensure the exposure to these risks is consistent with its risk tolerance and business

objectives.

116