Shaw 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

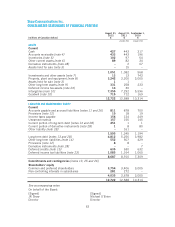

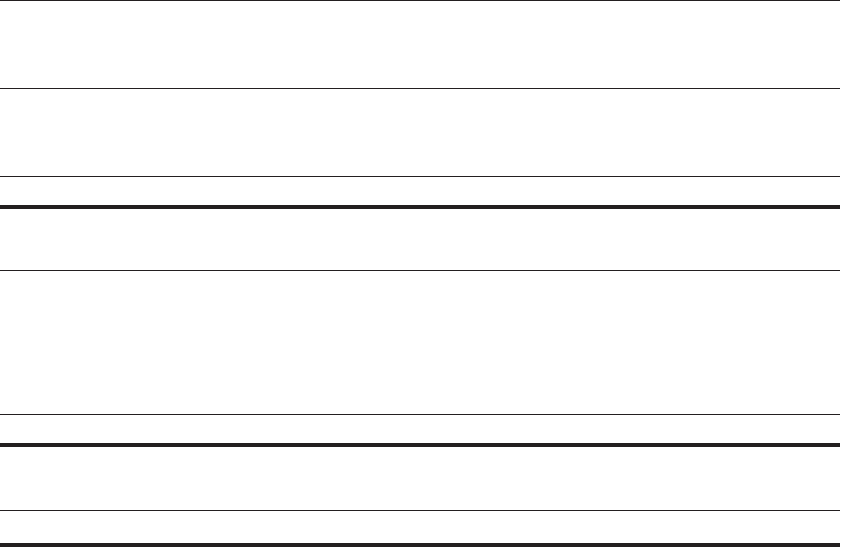

The Company’s interest in the assets, liabilities, results of operations and cash flows of these

joint ventures are as follows:

2012

$

2011

$

Current assets 812

Program rights –1

Property, plant and equipment 16 16

24 29

Current liabilities 11

Long-term debt 20 21

Proportionate share of net assets 37

2012

$

2011

$

Revenue 31 27

Operating, general and administrative expenses (14) (12)

Amortization (1) (1)

Interest (1) (1)

Other gains 11

Proportionate share of income before income taxes 16 14

Cash flow provided by operating activities 14 14

Cash flow used in financing activities (1) (1)

Proportionate share of cash distributions 13 13

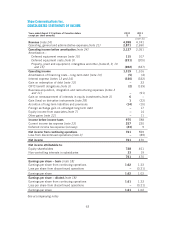

Non-controlling interests arise from business combinations in which the Company acquires less

than 100% interest. At the time of acquisition, non-controlling interests are measured at either

fair value or their proportionate share of the fair value of acquiree’s identifiable assets. The

Company determines the measurement basis on a transaction by transaction basis. Subsequent

to acquisition, the carrying amount of non-controlling interests is increased or decreased for

their share of changes in equity.

Investments and other assets

Investments in associates are accounted for using the equity method based on the Company’s

ability to exercise significant influence over the operating and financial policies of the investee.

Investments of this nature are recorded at original cost and adjusted periodically to recognize

the Company’s proportionate share of the associate’s net income or losses after the date of

investment, additional contributions made and dividends received. Investments are written

down when there has been a significant or prolonged decline in fair value.

Revenue and expenses

The Company has multiple deliverable arrangements comprised of upfront fees (subscriber

connection and installation fee revenue and/or customer premise equipment revenue) and

68