Shaw 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

benefit plan assets and liabilities to be presented in the statement of other

comprehensive income and is required to be applied retrospectively (with certain

exemptions) for the annual period commencing September 1, 2013.

ŠIAS 1, Presentation of Financial Statements, was amended to require presentation of

items of other comprehensive income based on whether they may be reclassified to the

statement of income and is required to be applied retrospectively for the annual period

commencing September 1, 2012.

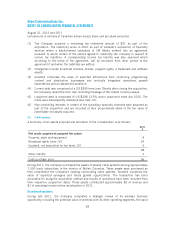

3. BUSINESS ACQUISITIONS AND DISCONTINUED OPERATIONS

Business acquisitions

2012

Television broadcasting businesses

$

Cash 21

Consideration for the equity interests held prior to the acquisition 9

30

Cumulative income from equity interests prior to acquisition 4

Gain on remeasurement of interests in equity investments 6

40

On May 31, 2012, the Company closed the acquisition of the partnership units of Mystery

Partnership (“Mystery”) and Men TV General Partnership (“The Cave”) not already owned by the

Company, for total consideration of $21. Prior to the acquisition, the Company held a 50%

interest in Mystery which was proportionately consolidated and a 49% interest in The Cave

which was accounted for under the equity method. The fair value of the previous ownership

interests in these specialty channels on the acquisition date was $19. The transaction is

accounted for using the acquisition method and as a result of remeasuring these equity

interests to fair value, the Company recorded a gain of $6 in the income statement. If the

acquisition had occurred on September 1, 2011, revenue and net income for the year would

have been approximately $12 and $2, respectively.

As part of the CRTC decisions approving the transaction, the Company is required to contribute

$2 in new benefits to the Canadian broadcasting system over the next seven years. The

contribution will be used to create new programming. The obligation has been recorded in the

income statement at fair value, being the discounted future cash flows using a 4% discount

rate.

80