Shaw 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

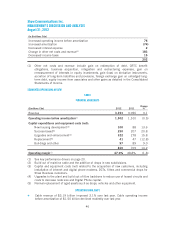

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2012

Shaw manages its exposure to floating interest rates through maintaining a balance of fixed and

floating rate debt. To mitigate some of the foreign exchange uncertainty with respect to capital

expenditures, the Company regularly enters into forward contracts in respect of US dollar

commitments. In order to minimize the risk of counterparty default under its swap agreements,

Shaw assesses the creditworthiness of its swap counterparties. Currently 100% of the total

swap portfolio is held by a financial institution with Standard & Poor’s ratings ranging from A+

to A-1. Further information concerning the policy and use of derivative financial instruments is

contained in Notes 2 and 28 to the Consolidated Financial Statements.

iv) Litigation

The Company and its subsidiaries are involved in litigation matters arising in the ordinary

course and conduct of its business. Although management does not expect that the outcome of

these matters will have a material adverse effect on the Corporation, there can be no assurance

that these matters, or other matters that arise in the future, will not have an adverse effect on

the Corporation’s business and operating results.

v) Uninsured risks of loss

The Company presently relies on two satellites (Anik F2 and Anik F1R) owned by Telesat

Canada (“Telesat”) to conduct its DTH and Satellite Services business. The Company has also

secured a dedicated payload (16 transponders plus 5 spares) on Telesat’s soon to be launched

Anik G1 satellite (projected in service date in early calendar 2013). The Company owns certain

transponders on Anik F2 and has long-term capacity service agreements in place in respect of

transponders on Anik F1R, Anik F2 and Anik G1. As the satellite owner, Telesat maintains

insurance policies on each of these satellites. In the case of Anik F1R and Anik F2, Shaw funds

a portion of the insurance cost such that in the event Telesat recovers insurance proceeds in

connection with an insured loss, Shaw will be entitled to receive certain compensation

payments from Telesat. The Company expects that Telesat will renew the insurance policies in

respect of Anik F1R and Anik F2 and that Shaw will continue to contribute to the cost of these

policies while they are in effect. In the case of Anik G1, Telesat will maintain insurance, at

minimum, for the launch and first five years of in orbit operation. Shaw maintains a security

interest in the transponder capacity and any insurance proceeds related thereto. The Company

does not maintain business interruption insurance covering damage or loss to one or more of

the satellites used in its DTH and Satellite Services business as it believes the premium costs

are uneconomic relative to the risk of satellite failure. Transponder capacity is available to the

Company on an unprotected, non-preemptible service level basis, in both the case of the Anik

F2 transponders that are owned by Shaw and the Anik F1R and Anik F2 transponders that are

secured through service capacity agreements. The Company has priority access to spare

transponders on Anik F1R and Anik F2 in the case of interruption, although there is no

assurance that such transponders would be available. In the event of satellite failure, service

will only be restored as additional capacity becomes available. Restoration of satellite service on

another satellite may require repositioning or re-pointing of customers’ receiving dishes. As a

result, the customers’ level of service may be diminished or they may require a larger dish. The

Anik G1 satellite has a switch feature that allows the whole channel services (transponders and

available spares) to be switched from extended Ku-band to Ku-band, which does provide the

Company with limited back-up to restore failed whole channel services on Anik F1R. Satellite

failure could cause customers to deactivate their DTH subscriptions or otherwise have a

material adverse effect on business and results of operations.

36