Shaw 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

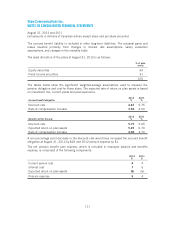

A one percentage point decrease in the discount rate would have increased the accrued benefit

obligation at August 31, 2012 by $65 and 2012 pension expensed by $1.

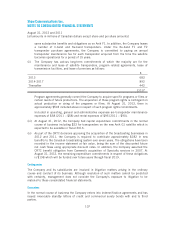

The net pension benefit plan expense is comprised of the following components:

2012

$

2011

$

Current service cost 76

Interest cost 19 16

Curtailment gain (25) –

Past service costs –1

Pension expense 123

The components of pension expense are included in employee salaries and benefits except for

the curtailment gain which is included in other gains in the income statement.

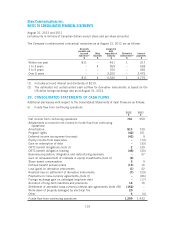

As part of the broadcasting business acquisition in 2011, the Company assumed a number of

funded defined benefit pension plans which provide pension benefits to certain unionized and

non-unionized employees. Benefits under these plans are based on the employees’ length of

service and final average salary.

The table below shows the change in the benefit obligations, change in fair value of plan assets

and the funded status of these defined benefit plans.

2012

$

2011

$

Accrued benefit obligation, beginning of year 119 –

Media business acquisition –124

Current service cost 44

Interest cost 76

Employee contributions 11

Actuarial losses (gains) 24 (7)

Payment of benefits to employees (6) (9)

Accrued benefit obligation, end of year 149 119

Fair value of plan assets, beginning of year 109 –

Media business acquisition –110

Employer contributions 10 6

Employee contributions 11

Expected return on plan assets 66

Actuarial losses (4) (5)

Payment of benefit and administrative expenses (6) (9)

Fair value of plan assets, end of year 116 109

Accrued benefit liability and plan deficit, end of year 33 10

110