Shaw 2012 Annual Report Download - page 75

Download and view the complete annual report

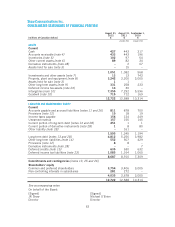

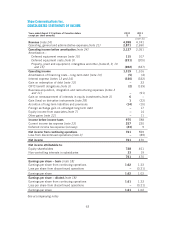

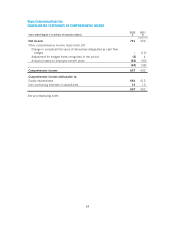

Please find page 75 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

amortized and are reported separately on the statement of financial position. The operating

results of a component that has been disposed of or is classified as held for sale are reported as

discontinued operations if the operations and cash flows of the component have been, or will

be, eliminated from the company’s ongoing operations and if the company does not have

significant continuing involvement in the operations of the component after the disposal

transaction. A component of a company includes operations and cash flows that can be clearly

distinguished, operationally and for financial reporting purposes, from the rest of a company’s

operations and cash flows. The Company does not allocate interest to discontinued operations.

Other long-term assets

Other long-term assets primarily include (i) equipment costs, as described in the revenue and

expenses accounting policy, deferred and amortized on a straight-line basis over two to five

years; (ii) credit facility arrangement fees amortized on a straight-line basis over the term of the

facility; (iii) long-term receivables; and (iv) the non-current portion of prepaid maintenance and

support contracts.

Intangibles

The excess of the cost of acquiring cable, satellite and media businesses over the fair value of

related net identifiable tangible and intangible assets acquired is allocated to goodwill. Net

identifiable intangible assets acquired consist of amounts allocated to broadcast rights and licenses,

trademarks, brands, program rights and software assets. Broadcast rights and licenses, trademarks

and brands represent identifiable assets with indefinite useful lives. Spectrum licenses were

acquired in Industry Canada’s auction of licenses for advanced wireless services and have an

indefinite life.

Program rights represent licensed rights acquired to broadcast television programs on the

Company’s conventional and specialty television channels and program advances are in respect

of payments for programming prior to the window license start date. For licensed rights, the

Company records a liability for program rights and corresponding asset when the license period

has commenced and all of the following conditions have been met: (i) the cost of the program is

known or reasonably determinable, (ii) the program material has been accepted by the Company

in accordance with the license agreement and (iii) the material is available to the Company for

telecast. Program rights are expensed on a systematic basis generally over the estimated

exhibition period as the programs are aired and are included in operating, general and

administrative expenses. Program rights are segregated on the statement of financial position

between current and noncurrent based on expected life at time of acquisition.

Software that is not an integral part of the related hardware is classified as an intangible asset.

Internally developed software assets are recorded at historical cost and include direct material

and labour costs as well as borrowing costs on qualifying assets for which the commencement

date is on or after September 1, 2010. Software assets are amortized on a straight-line basis

over estimated useful lives ranging from four to ten years. The Company reviews the estimates

of lives and useful lives on a regular basis.

Borrowing costs

The Company capitalizes borrowing costs on qualifying assets, for which the commencement

date is on or after September 1, 2010, that take more than one year to construct or develop

using the Company’s weighted average cost of borrowing.

71