Shaw 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

combine programming content with the Company’s cable and satellite distribution network to

create a vertically integrated entertainment and communications company.

The transaction has been accounted for using the acquisition method and results of operations

have been included commencing October 27, 2010. These broadcasting businesses have

contributed $891 of revenue and $252 of operating income before amortization for the period

from October 27 to August 31, 2011. If the acquisition had closed on September 1, 2010,

the Media revenue and operating income before amortization for the year would have been

approximately $1,075 and $325, respectively. Net income is not determinable due to

emergence of certain portions of the business from bankruptcy protection.

In 2011, acquisition related costs of $61 were expensed and include amounts incurred to

effect the transaction, such as professional fees paid to lawyers and consultants, as well

as restructuring costs to integrate the new businesses and increase organizational

effectiveness for future growth as well as senior leadership reorganization.

As part of the CRTC decision approving the transaction, the Company is required to

contribute approximately $180 in new benefits to the Canadian broadcasting system over

the next seven years. Most of this contribution will be used to create new programming on

Canwest services, construct digital transmission towers and provide a satellite solution for

over-the-air viewers whose local television stations do not convert to digital. The obligation

has been recorded in the income statement at fair value, being the sum of the discounted

future net cash flows using a 5.75% discount rate. In addition, the Company assumed the

CRTC benefit obligation from Canwest’s acquisition of Specialty services in 2007 which

was a remaining commitment of approximately $95 on acquisition.

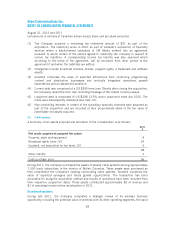

A summary of net assets acquired and allocation of consideration is as follows:

$

Net assets acquired at assigned fair values

Cash 83

Receivables 297

Other current assets(1) 147

Deferred income tax assets 27

Derivative instrument 16

Investments and other assets 16

Property and equipment 141

Intangibles(2) 1,651

Goodwill, not deductible for tax(3) 538

2,916

Current liabilities(1) 307

Current debt(4) 399

Derivative instruments(4) 82

Non-current liabilities 105

Deferred income tax liabilities 124

Long-term debt(5) 412

Non-controlling interests(6) 277

1,210

82