Shaw 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

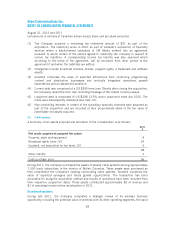

(ii) Broadcast rights and licenses and spectrum licenses – indefinite-life assessment

The Company’s businesses are dependent upon broadcast licenses (or operate pursuant to an

exemption order) granted and issued by the CRTC. In addition, the Company holds AWS

licenses to operate a wireless system in Canada. While these licenses must be renewed from

time to time, the Company has never failed to do so. In addition, there are currently no legal,

regulatory or competitive factors that limit the useful lives of these assets.

Standards, interpretations and amendments to standards issued but not yet effective

The Company has not yet adopted certain standards, interpretations and amendments that have

been issued but are not yet effective. The following pronouncements are being assessed to

determine their impact on the Company’s results and financial position.

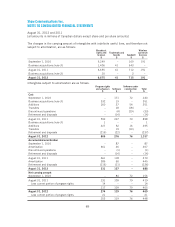

IFRS 9, Financial Instruments: Classification and Measurement, is the first part of the

replacement of IAS 39 Financial Instruments and applies to the classification and

measurement of financial assets and financial liabilities as defined by IAS 39. It is

required to be applied retrospectively for the annual period commencing September 1,

2015.

ŠThe following standards and amended standards are required to be applied retrospectively

for the annual period commencing September 1, 2013 and other than the disclosure

requirements therein, they must be applied concurrently:

ŠIFRS 10, Consolidated Financial Statements, replaces previous consolidation

guidance and outlines a single consolidation model that identifies control as the

basis for consolidation of all types of entities.

ŠIFRS 11, Joint Arrangements, replaces IAS 31 Interests in Joint Ventures and SIC

13 Jointly Controlled Entities – Non-Monetary Contributions by Venturers. The new

standard classifies joint arrangements as either joint operations or joint ventures.

ŠIFRS 12, Disclosure of Interests in Other Entities, sets out required disclosures on

application of IFRS 10, IFRS 11, and IAS 28 (amended 2011).

ŠIAS 27, Separate Financial Statements was amended in 2011 for the issuance of

IFRS 10 and retains the current guidance for separate financial statements.

ŠIAS 28, Investments in Associates was amended in 2011 for changes based on

issuance of IFRS 10 and IFRS 11 and provides guidance on accounting for joint

ventures, as defined by IFRS 11, using the equity method.

ŠIFRS 13, Fair Value Measurement, defines fair value, provides guidance on its

determination and introduces consistent requirements for disclosure of fair value

measurements and is required to be applied prospectively for the annual period

commencing September 1, 2013.

ŠIAS 12, Income Taxes (amended 2011), introduces an exception to the general

measurement requirements of IAS 12 in respect of investment properties measured at fair

value. It is required to be applied retrospectively for the annual period commencing

September 1, 2012.

ŠIAS 19, Employee Benefits (amended 2011), eliminates the existing option to defer

actuarial gains and losses and requires changes from the remeasurement of defined

79

Š