Shaw 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

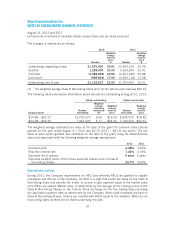

2011

Satellite

Cable

$

Media

$

DTH

$

Satellite

Services

$

Total

$

Intersegment

eliminations

$

Total

$

Revenue 3,096 891 745 82 827 (73) 4,741

Operating income before amortization 1,510 252 246 43 289 – 2,051

Operating income as % of revenue 48.8% 28.3% 33.0% 52.4% 34.9% – 43.3%

Interest(1) 312

Burrard Landing Lot 2 Holdings Partnership 1

Wireless 19

332

Cash taxes(1) 240

Corporate/other (20)

220

Capital expenditures and equipment costs (net) by

segment

Capital expenditures 677 27 6 26 32 – 736

Equipment costs (net) 32 – 75 – 75 – 107

709 27 81 26 107 – 843

Reconciliation to Consolidated Statements of Cash

Flows

Additions to property, plant and equipment 705

Additions to equipment costs (net) 120

Additions to other intangibles 65

Total of capital expenditures and equipment costs

(net) per Consolidated Statements of Cash Flows 890

Increase in working capital related to capital

expenditures (4)

Increase in customer equipment financing receivables (13)

Less: Proceeds on disposal of property, plant and

equipment (27)

Less: Satellite services equipment profit(2) (3)

Total capital expenditures and equipment costs (net)

reported by segments 843

(1) The Company does not report interest or cash taxes on a segmented basis. Interest was

allocated to the discontinued Wireless division in 2011 based on the Company’s average

cost of borrowing to fund the capital expenditures and operating costs and therefore has

not been included in discontinued operations.

(2) The profit from the sale of satellite equipment is subtracted from the calculation of

segmented capital expenditures and equipment costs (net) as the Company views the

profit on sale as a recovery of expenditures on customer premise equipment.

25. COMMITMENTS AND CONTINGENCIES

Commitments

(i) During prior years, the Company, through its subsidiaries, purchased 28 Ku-band

transponders on the Anik F1 satellite and 18 Ku-band transponders on the Anik F2

satellite from Telesat Canada. During 2006, the Company’s traffic on the Anik F1 was

transferred to the Anik F1R under a capacity services arrangement which has all of the

106