Shaw 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2012

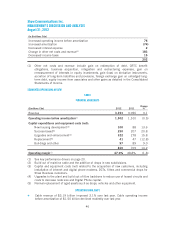

II. SUMMARY OF QUARTERLY RESULTS

Quarter Revenue

Operating

income

before

amortization(1)

Net income

from

continuing

operations

attributable

to equity

shareholders

Net income

attributable

to equity

shareholders

Net

income(2)

Basic

earnings

per share

from

continuing

operations(3)

Basic

earnings

per share(3)

($millions Cdn except per share amounts)

2012

Fourth 1,210 501 129 129 133 0.28 0.28

Third 1,278 567 238 238 248 0.53 0.53

Second 1,231 493 169 169 178 0.38 0.38

First 1,279 566 192 192 202 0.43 0.43

Total 4,998 2,127 728 728 761 1.62 1.62

2011

Fourth 1,181 481 164 81 84 0.37 0.18

Third 1,285 586 197 195 201 0.45 0.45

Second 1,196 505 166 163 169 0.38 0.37

First 1,079 479 13 12 16 0.03 0.03

Total 4,741 2,051 540 451 470 1.23 1.02

(1) See key performance drivers on page 20.

(2) Net income attributable to both equity shareholders and non-controlling interests.

(3) Diluted earnings per share from continuing operations and diluted earnings per share is

$1.61 for 2012. Diluted earnings per share from continuing operations and diluted

earnings per share for 2011 is $1.23 and $1.02, respectively.

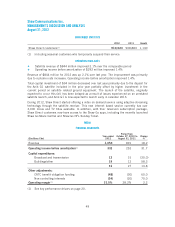

Generally, revenue and operating income before amortization have grown quarter-over-quarter

mainly due to customer growth and rate increases with the exception of the fourth quarters of

2012 and 2011 and second quarter of 2012. In the second quarter of 2012, revenue and

operating income before amortization decreased by $48 million and $73 million, respectively,

due to the seasonality of the Media business with higher revenues in the first quarter driven by

the fall launch of season premieres and high demand as well as lower operating income before

amortization in the Cable division. Operating expenses increased in the second quarter which

included employee related costs, mainly related to bringing the new customer service centres

on line, as well as higher marketing, sales and programming costs. The fourth quarters of 2011

and 2012 were both impacted by the cyclical nature of the Media business with lower

advertising revenues in the summer months. Accordingly, in the fourth quarter of 2011,

revenue and operating income before amortization declined $104 million and $105 million,

respectively, while in the fourth quarter of 2012, revenue and operating income before

amortization declined $68 million and $66 million, respectively. The impact of the Media

business in the fourth quarter of 2012 was partially offset by improved operating income before

amortization in the Cable division.

Net income has fluctuated quarter-over-quarter primarily as a result of the growth in operating

income before amortization described above and the impact of the net change in non-operating

items. In the fourth quarter of 2012, net income decreased by $115 million, primarily due to

39