Shaw 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2012

$26 million related to an electrical fire and resulting water damage to Shaw Court as well as a

pension curtailment gain of $25 million. The loss of $26 million includes $6 million of costs in

respect of restoration and recovery activities, including amounts incurred in the relocation of

employees, and an asset write-down of $20 million related to the damages sustained to the

building and its contents. Insurance recoveries are expected and amounts will be included in

Other gains as claims are approved. No insurance recoveries were recorded in 2012. The

pension curtailment gain arose due to a plan amendment to freeze base salary levels.

Income tax expense

The income tax expense was calculated using current statutory income tax rates of 26.3% for

2012 and 27.9% for 2011 and was adjusted for the reconciling items identified in Note 23 to

the Consolidated Financial Statements.

Loss from discontinued operations

In 2011, the Company discontinued further construction of its traditional wireless network and

accordingly, all traditional wireless activities have been classified as discontinued operations.

The Company recorded an after tax loss of $89 million comprised of a write-down of assets of

$112 million, operating expenditures and amortization of $8 million and an income tax

recovery of $31 million.

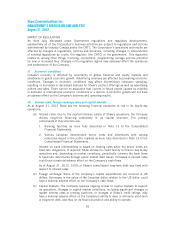

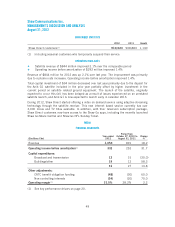

Earnings per share from continuing operations

(In $millions Cdn except per share amounts) 2012 2011

Change

%

Net income from continuing operations 761 559 36.1

Weighted average number of participating

shares outstanding during period (millions) 441 435 1.4

Earnings per share from continuing operations –

Basic 1.62 1.23 31.7

Diluted 1.61 1.23 30.9

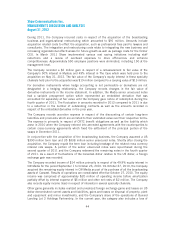

Net income from continuing operations

Net income from continuing operations was $761 million in 2012 compared to $559 million in

2011. The year-over-year changes are summarized in the table below.

Net income from continuing operations increased $202 million over the prior year. The current

year benefitted from a reduction in net other costs of $183 million, improved operating income

before amortization of $76 million and decreased income taxes of $15 million partially offset

by higher amortization of $74 million. The change in net other costs and revenue of $183

million was due to amounts recorded in the prior year and were primarily in respect of the

Media business acquisition. These amounts included the CRTC benefit obligation, various

acquisition, integration and restructuring costs and the loss on derivative instruments partially

offset by the gain on redemption of debt, foreign exchange gain on unhedged long-term debt

and equity income from associates.

45